COVID: preparing Xero for Job Keeper

***as at 20 April 2020***

Sometimes we just need someone to spell it out for us, right?

This blog is for anyone who

- Uses Xero accounting software*, and

- Intends to receive the Job Keeper payments, and

-

Has employees

If you have no idea what I am talking about, no stress. Check out the 2 blogs I wrote earlier on COVID support available to employers. Make sure you have a nomination form for each of the employees. If you are a sole trader or nominating yourself as an eligible business participant of one of your entities, then hold tight because we will give me info reporting on that later (direct to ATO).

*Xero is our fav for a bunch of reasons for our clients, but we're not being paid to promote them

Job Keeper - Xero

NEW INFO: Xero now have a few new functions and reports in Xero to help you re applying for JobKeeper. You can read in more depth about who can apply, when and how in our blog.

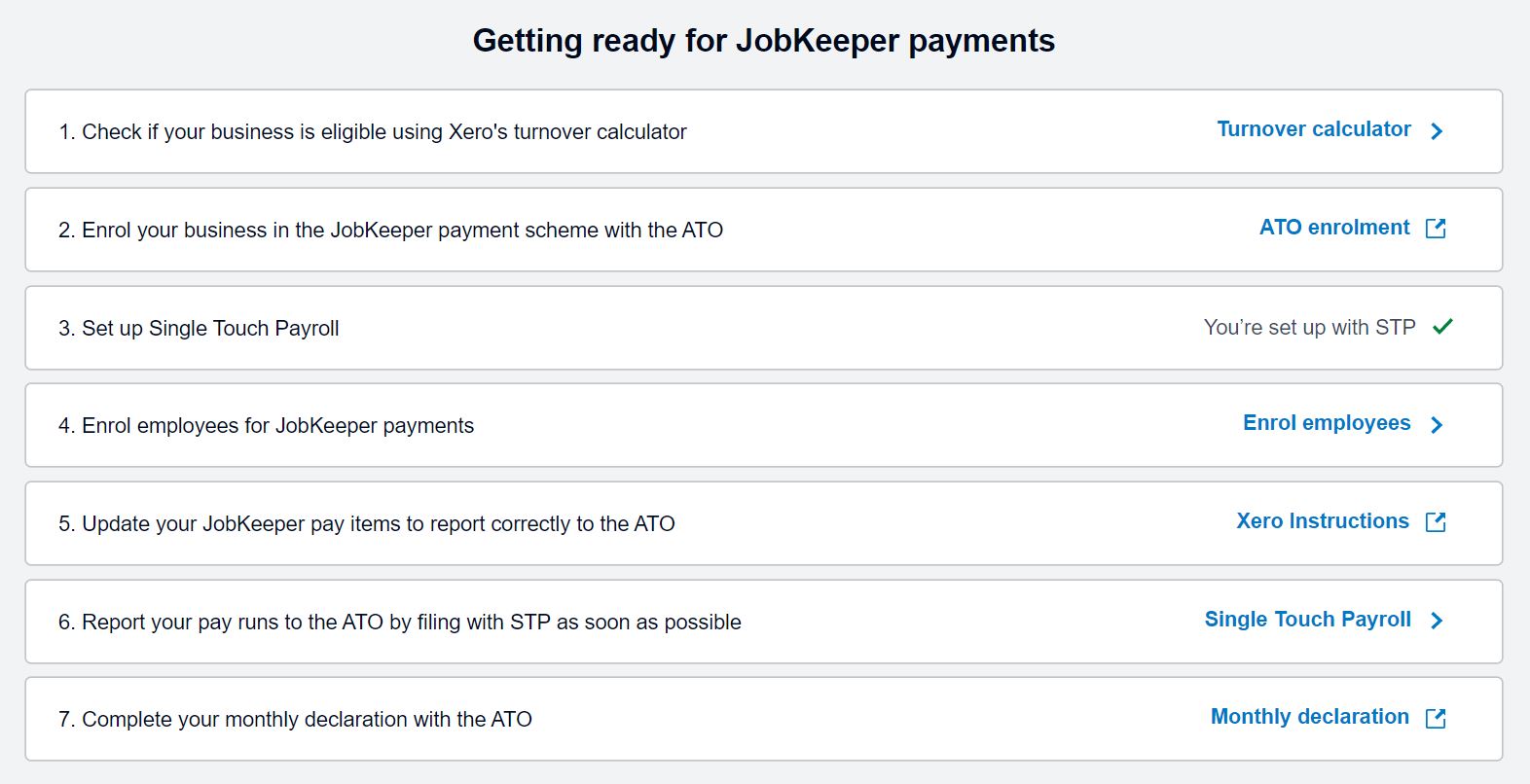

NEW INFO: In Xero they have a handy 'checklist' to help you get ready for JobKeeper reporting re payments to employees and eligible employees.

You can access this in your file:

- Log into Xero

- Payroll (up the top)> Pay employees (drop down menu)

- Then clicking "view support page".

Then work your way through this:

Re Step 5, on the list...

Our wonderful friends at Xero HQ have put together some info - the below includes some screenshots and 'translation' from me.

To record a JobKeeper 'top up' payment, set up a new allowance pay item. You can then either add the pay item to the employee’s pay template or payslip.

Why

If all of this applies to you, then you need to

- pay your eligible employees a minimum of $1,500 per 'Job Keeper' fortnight

- report to the ATO each month, and you have 7 days after the end of the calendar month to do this

If you are using Xero and STP, and you keep it all beautifully up to date, then a lot of what needs to be reported could all be looked after for you automatically.

How to set it up

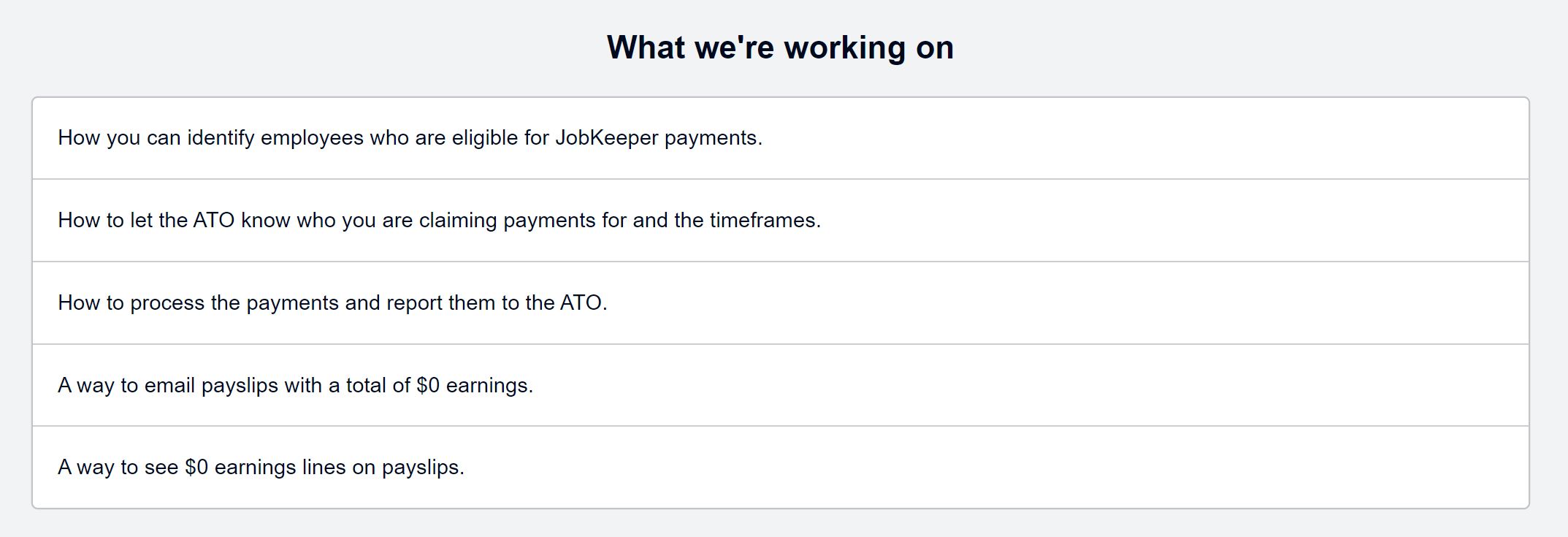

Xero has told us they have their software developers working hard in the background to make us some new payroll features to handle this.

In the meantime, this is the best thing to do.

Before you get started in Xero

- Register your interest with the ATO

- Sign up for STP if you haven't already (which you probably should have) - see instructions here

Then log into Xero.

Payroll Settings

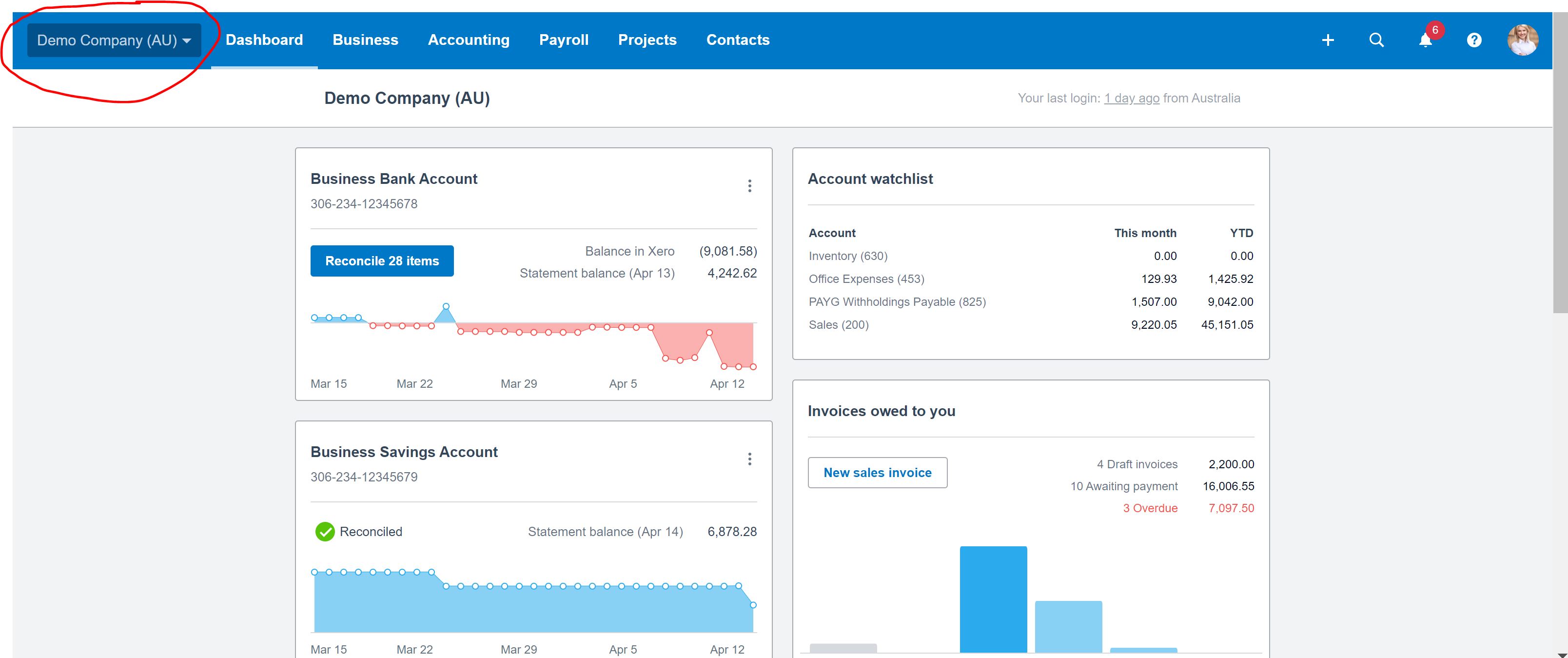

Click on the organisation name, select Settings, then click Payroll settings.

Select the Pay Items tab, then select Earnings.

- Under Type, select Other.

- Enter an Earnings Name (eg ‘JobKeeper payment top up’).

- Under Rate Type, select Fixed Amount, then set the Amount to zero.

We do this so we can calculate the amount manually for each employee, each pay run and enter it in the timesheet. This is designed as a TOP UP only. i.e. if you usually pay them $1,300 then there will be $200 to top up, to get to the minimum $1,500 Job Keeper amount. If you usually pay them $1,800 then no need to make any changes to their payslip etc because you are already paying above the minimum.

- Select the relevant Expense Account, such as ‘Wages and Salaries’.

- Leave the Exempt from PAYG Withholding checkbox empty.

- (Optional) Select the Exempt from Superannuation Guarantee Contribution checkbox.

- Select the Reportable as W1 on Activity Statement checkbox.

Click Add.

Update Pay Templates in Xero

Now, we have the settings ready to go so we need to make sure this pay type is applied to our employees in Xero, and update any templates we have set up for them.

In the Payroll menu, select Employees.

Click the employee name.

Select the Pay Template tab.

Click Add Earnings Line and select JobKeeper type from the drop down.

Click OK then SAVE.

Now you are ready to actually pay your staff! ***REMEMBER*** the start of the first 'JobKeeper' fortnight begins 30th March 2020. Xero reporting and STP link to the ATO is going to take care of the timing stuff for you.

Update Pay Templates in Xero

In the Payroll menu, select Pay Employees.

Click Add Pay Run (or select your DRAFT one), select a pay period, then click Next.

See how STP has not been filed here? Get on top of that my friends.

Click the employee’s name to open the payslip.

Check your employee's usual earnings lines are accurate. If applicable, you can add employee stand down hours. If you have stood down hours you might need another JobKeeper pay type (in settings) because different rules apply to annual leave accruals etc.

If you added the new earnings pay item to the employee’s pay template, it will appear here. If not, click Add Earnings Line. Under Earnings Rate, select the new earnings pay item created above, then click OK.

In the earnings line for the JobKeeper payment top up, enter the Fixed Amount. For information on calculating the fixed amount for the payment, see the ATO website.

Click Save.

Repeat the steps above for each employee as required, then post the pay run.

Done!!

We will continue to update this as more information and updates are released. If you need a hand, just send us an email.

xxx Lauren