Tease and Tax Time

Really working those ASSets?

Thinking of working in the adult entertainment industry?

The statement ‘your body, your business’ couldn’t be more true, and in more ways than one. The money you are earning is not magical free money with no obligations or tax, and it needs to be reported. We know your work is real work and we just want to help you to answer the big question…

What are the things to look out for during tax season?

To help you have a stress free tax filing at the end of the financial year there are a few things to keep in mind:

- The legal stuff - read our little guide here on where we (have to) stand on this stuff

- ABN

- Record keeping

- Deductions

ABN = Australian Business Number

If you are operating as a sole trader you might need to get yourself an ABN. It is best to chat to your accountant of course, to make sure this is right for you. If it is, and you want to get an ABN, you can do it yourself here (or ask your accountant to do it for you).

Becoming a sole trader is pretty simple and very cost-effective (free to register). It does mean that you are the same legal entity as your business. When it comes time for tax, you will have one tax return (for you) and it will now include an extra worksheet at the back for your ‘business’.

Another legal structure (Company, Trust etc.) might end up being better for you (for lots of reasons) so we really encourage you to chat to an accountant!

Record Keeping

You need to record your income and your expenses. If you do this regularly, throughout the year, it will make life easier for you later down the track.

When we say income, we mean all income. Our job as accountants is not to hide money, it is to help you to record accurate information and to report numbers to the ATO that are a true and fair presentation of your income (and in a way that is compliant with the law). This means, income from bookings, dances, tips etc. are all taxable income.

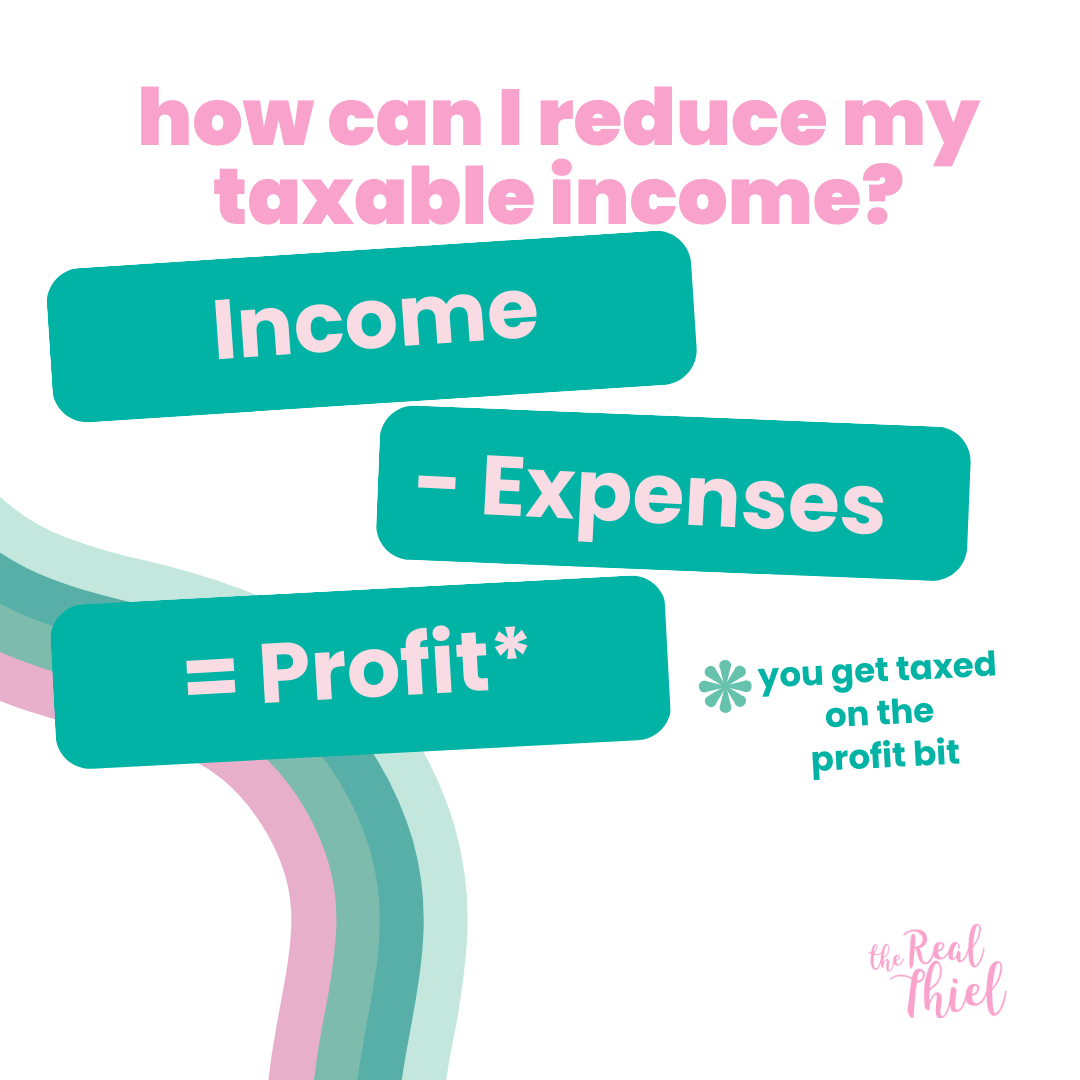

But, you can reduce the taxable income, by the amount of allowable deductions, like this:

Spreadsheets are a really good option. They are free, reasonably easy to use (from a laptop) and allow us to add stuff up really quickly and make changes if we need to. We always provide our clients with a very handy ‘income and expenses’ spreadsheet template.

We have built a special spreadsheet called Figure$, designed especially with SW in mind, available for purchase here. It lets you record income per dance (or other booking), per night or week. It sums it all up for you. It calculates your averages, forecasts your potential income for the year and even gives you an estimate of your likely tax bill. You can team this with our other tax spreadsheets if you like.

your body, your business!

Accounting software is something you generally pay for, and it gets a feed from your bank (like a copy of your bank statement). You then ‘tag’ or categorise the money, and the system keeps track of everything and then spits out reports when you (or we the accountants) need it.

If you are not sure what system is best for you, use our form here to guide your decision.

Receipts need to be kept for all expenses you want to claim. If you pay cash, fine, but get a receipt! We recommend you take a photo of each receipt or save the PDFs, and keep them organised in Google Drive, and organised by financial year. This means you have the receipts in case you are ever audited, and they are tidy and easy to find.

Deductions

Everyone’s #1 question… but what can I deduct!?

We have another blog outlining common deductions we see for our creative industry clients, and we believe SW fits in that. Check it out here.

So now let's start identifying the deductible expenses you may claim during tax time. Deductible expenses are the transactions you paid that are directly related to earning your income.

Here are the list of common deductions of strippers, exotic dancers, SWers and other amazing individuals in the industry that we commonly see:

- Clothing & Footwear (& Costumes)

- Props and Materials

- Tools & Equipment

- Laundry/Dry Cleaning

- Hair & Make Up

- House Fee / Rent

- Education and Professional Development

- Consumables (like lube or pole grip)

- Car Expenses / Parking / Travel (sometimes!)

And three of our favourites:

- Tax accountant fees

- Making contributions to your superfund

- Donations (to DGR status organisations)

This list is not exhaustive, and you should look at your own actual expenses and consider (with help from your accountant) if those expenses qualify and might be ok to deduct for tax purposes.

For some more info and guidance on these, read on my friend:

Clothing & Footwear (& Costumes)

We know that fashion statements nowadays are a big factor on how we express our personality. This works the same during your performances. To catch your audiences’ attention, you need specific clothes that can establish a persona to help open their imagination.

Some great examples would be:

- stage clothing like lingeries

- costumes to portray a character

- Pleasers or other industry specific clothes and footwear that you specifically use during your performances

You can’t claim for everyday clothes or things you might wear outside of your ‘costume’.

Props and Materials

From igniting your audiences’ imagination through your outfit, you can spice it up more by using props and materials. From feathery scarves and quirky hats to leather whip and handcuffs, if these kinky accessories are used for your performances and income-earning activities, it can be considered as deductible expenses. If they are for your own bedroom or personal life, then not deductible!

Tools & Equipment

From kinky outfits to props and materials, there is one more way to hook your audiences and that is through using some tools and equipment. Common example of these in the adult industry are:

- pole

- fetish equipment

- adult novelties

- vibrators

- webcam for online shows

Laundry/Dry Cleaning

You can claim a deduction for the costs you incur to wash, dry and iron the specific clothing and costume you wear for your performances.

If your laundry expense is $150 or less (excluding dry-cleaning ), keeping a record is not really necessary. However, this is not an automatic deduction, so you still need to show how you came up with the computation.

The reasonable basis for your laundry claim is:

- $1 per load if it only contains work specific clothing

- 50c per load if it is mixed with other personal items of clothing.

Hair & Make Up

Though grooming expenses are generally not deductible, like a regular haircut, hair treatment and makeup products you use for everything else, there are several guidelines for this.

- You use makeup to look in a particular way for your stage performances. If you don’t have a specific set for your shows, you may still claim according to its business use. Say 50% business use and 50% personal use.

- Hair products like hair spray to keep your hair in place while performing would be deductible.

This category is a classic ‘it depends’ and might be worth discussing with your accountant.

House Fee

Some clubs charge for cleaning or for renting a pole or whatnot. If you pay a fee to perform or work, and if you get a receipt, consider deducting that from income declared.

Education and Professional Development

This includes expenses related to self-education and study expenses that are related to your work or business. The main purpose of this expense is to maintain or improve your skills that are necessary for your work activities or stage performances. We have a full blog on this here.

Some common examples are:

- Course and tuition fees for dance classes like pole dancing and other classes dedicated for strippers and exotic dancers

- Student services and amenities fees

- Payment for video materials for online classes

Consumables

Consumables include small, everyday items that are necessary for your business. In the adult industry these items are valid deductions: condoms, lubricants, gels, oils and tissues.

Remember, keep receipts!!

Car Expenses

This one depends and is a bit more involved. We’ve dedicated a whole blog post to it that you can read here.

Tax Accountant

Paying a tax agent for their services is generally an allowable deduction.

Super

It is likely that no one else is putting money into your super fund if you are self-employed, so we definitely encourage you to be doing it. You can make your own contributions and in some situations, claim that amount as a tax deduction. Read more here.

Donations

Good for them and good for you! Read more here about how it works.

Now that we list down the common deductions that you should watch for, hope you have less worries about tax filing.

You might like to track everything in our new FIGURE$ spreadsheet - check it out here.

We’re always here if you want us to help at tax time, so if you’re not already a Real Thiel client, head to the contact page and fill in the ‘get quote’ form.

Sources

Deductions - Adult Industry ATO