Parcel Picking & the CGT ‘Min Method’

You know that moment when your trading app proudly announces:

“You sold 1,000 units of [ETF/Share]!”

…and then tax time hits and suddenly your accountant (aka: me) is gently asking:

“Cool, but which 1,000 units? Was it the first ones I bought 20 years ago, or a mix of the ones I bought last year and some this year? They all have different purchase prices, so how do I calculate the gain or loss?”

If your brain immediately checks out, don’t worry! Parcel picking sounds like a Level 99 Tax Wizard spell, but really it’s just one of the many legal tools the ATO lets us use to help manage (and sometimes minimise) your capital gains tax.

Let’s break it down the fun, human way.

What Even Is ‘Parcel Picking’?

Every time you buy the same share/ETF at a different time or price, you’re creating a parcel.

Example:

2020 – Bought 1,000 units of BHP @ $30

2022 – Bought 1,000 units @ $40

2024 – Bought 1,000 units @ $45

Congrats! You now have 3 parcels of BHP.

When you sell 1,000 units later (for say $50 per unit), the ATO actually lets you choose which parcel you sold as long as your records support that choice. This method is officially known as specific identification, but in the accounting world we often call it:

- Parcel picking

- Specific ID

- The CGT minimisation method (the informal slang version)

And no, ‘first in first out’ (FIFO) isn’t the only option - FIFO is basically the ATO’s backup plan if you have zero records or your broker doesn’t give enough detail. This would mean we assume that if you bought 3 parcels, then sell 1, that you are selling them in order, i.e. that you have then just sold the first parcel that was bought originally.

The gain or loss you be calculated as (simplified):

Sales value Parcel sold: $42 x 1,000 units = $42,000

(-) Purchase price Parcel 1: $30 x 1,000 units = $30,000

= $42,000 - $30,000

= $12,000 gain

Why Parcel Picking Actually Matters

Different parcels = different tax outcomes.

Using the same BHP example, say you sell 1,000 units at $42:

- If we pick the $45 parcel → capital loss ($42 x 1,000 − $45 x 1,000 = -$3,000)

- If we pick the $40 parcel → small capital gain ($42 x 1,000 - $40 x 1,000 = +$2,000)

- If we pick the $30 parcel → bigger capital gain ($42 x 1,000 - $30 x 1,000 = +$12,000)

Same sale. Same number of units. Completely different tax result.

This is why we care. And why you should too.

So… What’s the ‘CGT Min Method’?

Important note: This is not an official ATO term — it’s accountant slang.

The CGT minimisation method simply means:

We pick the parcel(s) that result in the lowest capital gain (or the biggest capital loss).

Usually that means selling:

- Your highest cost‑base parcels first, or

- Parcels that produce capital losses to help offset other gains.

But it’s not always about minimising tax immediately - sometimes it’s smarter to trigger more gains now (e.g. when you’ve got carried-forward losses you want to use). Parcel picking lets us play the long game.

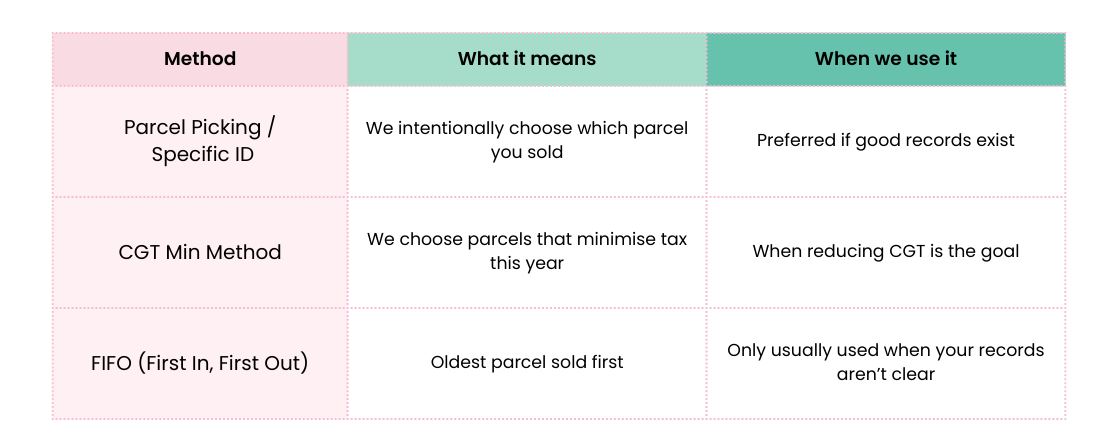

Parcel Picking vs FIFO vs ‘Min Method’

FIFO isn’t ‘wrong - it’s just… boring and automatic, and may not give you the best, most strategic tax position possible. Parcel picking lets us actually think and get you the best outcome.

ATO Requirements:

The ATO does allow parcel selection as long as:

✔️ You have clear records showing which parcels you own (trade confirmations, broker statements, CSV exports)

✔️ The choice is made at the time of sale (not something we ‘rewrite’ years later)

✔️ Cost bases are accurate and supported (no made‑up numbers!)

If records aren’t good enough or your broker can’t identify the parcels, the ATO requires us to use FIFO by default. This is yet another reason we keep encouraging you to keep good records!

Examples:

Example 1: The Illustrator Who Bought ‘VibesCoin’

Bella buys crypto for fun between commissions:

- $1,000 @ $2

- $1,000 @ $5

- $1,000 @ $8

She sells 1,000 quits when the price is $6 = $6,000 incoming. But what is the gain/loss?

If we pick the $8 parcel → capital loss! $6,000 in, but it originally cost $8,000 for that parcel

If we pick the $2 parcel → bigger capital gain. $6,000 in, and it only cost $2,000 for that parcel

Bella chooses the $8 parcel because the capital loss helps to lower her tax bill — and uses the savings to buy new Procreate brushes.

Example 2: The Filmmaker Funding Their Short Film

Levi bought shares while saving for a camera:

- Parcel A: Bought at $20

- Parcel B: Bought at $32

He sells at $30.

If we use Parcel B → loss → helpful for tax

If we use Parcel A → gain → not ideal this year

Smart choice? Parcel B. More budget for fog machines.

Example 3: The Musician Who Dollar‑Cost Averages

Mina (yes, this is for all my musician clients ❤️🎶) buys ETF units regularly:

- $50

- $60

- $75

She sells at $65.

Pick $75 parcel → loss

Pick $60 parcel → tiny gain

Pick $50 parcel → bigger gain

Picking the $75 parcel helps her keep her taxable gains low — and maybe upgrade that pedalboard.

What We Do for You at The Real Thiel

Here’s our behind‑the‑scenes magic:

- Rebuild your parcel history (every buy, date, cost, quantity)

- Look at your whole tax year picture

- Apply parcel picking strategically

- Calculate capital gains with the 12‑month CGT discount in mind

- Show you the clean, easy‑to-read final CGT numbers

And yes, we use an internal CGT parcel‑picking workbook because it helps keep things consistent, accurate and less painful for both of us.

What You Can Do to Make Your Life (and Ours) Easier

- Keep your trading on as few platforms as possible

- Download your transaction reports annually

- Before doing your tax return, ask us: “Is there a better parcel we can pick?”

Even a quick message can make a big difference.

Need Help With Your Parcels?

If you’ve sold shares, ETFs, or crypto and you're not sure which parcels were sold — we can:

- Rebuild your parcel history

- Apply the CGT min method if it suits your strategy

- Prepare the summaries you need for your tax return

Just reach out — we’ll walk you through it.

And yes… you can keep sending us screenshots of your trading apps. We’ve seen it all.

ATO Official References (Direct Links)

- Capital Gains Tax – Main ATO Page

- Capital Gains Tax Guide (2025 / current financial year)

- Capital Gain or Capital Loss Worksheet

- Keeping Records of Shares and Units (ATO—supports parcel identification requirement)

- Identifying Shares or Units Sold (ATO—archived but still relevant)

- Cost Base of an Asset (ATO)