Not All Heroes Wear Capes – Some Are Disguised as Tax Offsets | pt 2

Part 2: Tax Offsets for Companies

We’re now on Part 2 and the final instalment of our tax offset mini-series – this time focusing on tax offsets available for companies.

Compared to individual tax offsets, company tax offsets are fewer, but they still make a meaningful difference to a company’s final tax bill.

Before we dive in, here’s a quick refresher on how tax deductions and tax offsets differ:

- Tax deductions reduce your taxable income(gross income less allowable expenses) i.e. $1 of a deduction might equate to $0.30 off the tax bill or something like that

- Tax offsets reduce your tax payable(taxable income multiplied by the company tax rate)

I.e. $1 of a tax offset is $1 off the tax bill

Deductions work before tax is calculated, while offsets step in after – directly lowering the amount of tax you need to pay.

These are the common tax offsets available to companies, which we’ll walk through below.

1. Franking Tax Offsets

One of the more complex parts of a company’s tax return involves franking tax offsets – and honestly, it can get pretty technical.

Company ‘A’ can own shares in another Company ‘B’. If ‘B’ shares its profits with its shareholders, through a dividend, that dividend may be ‘franked’, meaning the Company ‘B’ has already paid tax on that profit, so the dividend to owners comes with a ‘credit’ (to avoid double taxation).

When a company receives franked dividends (dividends with attached franking credits), the amount of tax already paid by the distributing company is credited to the recipient company as a franking tax offset. In practical terms, the franking offset matches the tax the company has already paid on that income.

Think of a franking credit as a tag attached to dividend income that says, “tax for this amount has already been paid.” The recipient company gets a tax offset equal to that credit, which can reduce its tax payable on other income.

Why This Matters for Companies

If your company earns income (including franked dividends), the franking tax offset can reduce your tax payable before you actually pay any tax for the year. When your franking credits plus other offsets are enough to cover your tax liability, your company may have no tax payable for that income year. *fingers crossed*

In cases that your company has more franking tax offsets than tax payable, the excess isn’t refunded to the company, but it doesn’t go to waste either. Instead, it can be converted into a tax loss and carried forward to future years and used to reduce future taxable income (but still subject to ATO rules).

Example:

Imagine your company receives a franked dividend which includes a franking credit of $10,000 (representing tax already paid by the distributing company). If your company’s tax payable for the year before offsets is $10,000 as well, the franking tax offset could completely wipe out your tax bill for that year – meaning no tax payable.

But if your company’s tax payable is less than the franking tax offset – say, $5,000 – the extra $5,000 is not refundable. Instead, it can potentially be converted into a tax loss that you can carry forward and apply in future years to reduce your tax.

The rules around franking tax offsets involve detailed interactions with:

- Your corporate tax rate and imputation accounts,

- How excess franking credits are treated, and

- The conversion of unused offsets into tax losses.

These details can be tricky to navigate, so having your accountant walk you through the figures will make sure you’re taking full advantage of the franking system without mistakes.

2. Foreign Income Tax Offset (FITO)

When your company earns income from overseas, you might end up paying tax on that income twice – once to the foreign government and again under Australian tax rules, creating a kind of “double tax” situation. The Foreign Income Tax Offset (FITO) is here to help prevent that.

FITO lets your company reduce its Australian tax payable by the amount of foreign tax already paid on that income. It gives you a credit for tax you’ve already paid overseas, so you don’t end up paying for it twice.

To be eligible, your company must:

- Have actually paid foreign tax, and

- Include the related foreign income in its Australian assessable income. This could be foreign business income, investment income, or even capital gains, as long as the income is reported in Australia.

How it works:

Once you’ve paid foreign tax and included the income in your Australian return, the FITO can reduce the tax your company owes. If the foreign tax was paid in a different year from when the income was reported, you can usually still claim it by amending the return for that year. FITO is limited to the lesser of foreign tax paid and Australian tax payable on that foreign income. It’s also worth noting that foreign tax paid does not automatically equal the FITO entitlement the tax treaty for the corresponding country must be checked.

Example:

Your company earns income overseas and pays $20,000 in foreign tax. Since that same income is included in your Australian assessable income, you may be able to claim up to $20,000 as a FITO, reducing your Australian tax bill.

A friendly reminder: FITO can get a bit detailed, especially if foreign tax was paid in a different year or if there are capital gains or complex foreign arrangements involved. But no need to worry as this is exactly where your accountant comes in to save the day!

3. Research and Development Tax Offset

If your company is doing innovative work – experimenting, improving products, or pushing into new technological territory – you might be eligible for the Research and Development (R&D) Tax Offset. This offset is part of the Australian Government’s R&D Tax Incentive, designed to encourage companies to undertake research and development they might not otherwise do. It’s a tax offset that can reduce your company’s tax payable based on eligible expenses you’ve incurred on R&D activities. The R&D program is jointly administered by the ATO and the Department of Industry, Science and Resources (DISR), and your activities must be registered before claiming.

Eligibility - your company must:

- Be an R&D entity (a corporation carrying on a business).

- Conduct eligible R&D activities – activities that involve experimentation and generate new knowledge, not just routine work.

- Register your R&D activities with the government within 10 months of the end of your income year before claiming the offset.

- Have notional R&D deductions (eligible R&D expenses) of at least $20,000 unless you use a registered Research Service Provider (RSP).

Different Offset Rates

The amount of R&D tax offset your company can claim isn’t a flat rate. It depends on your company’s turnover and how much you’re spending on eligible R&D.

- Smaller companies (aggregated turnover less than $20 million):

They may be entitled to a refundable offset, meaning the benefit can result in a tax refund if the offset exceeds tax payable.

- Larger companies (turnover $20 million or more):

They can receive a non‑refundable offset, which reduces their tax payable but won’t refund more than they owe in tax.

The current structure includes a combination of the corporate tax rate plus a premium depending on your R&D intensity – by how much you spend on R&D relative to your overall expenses.

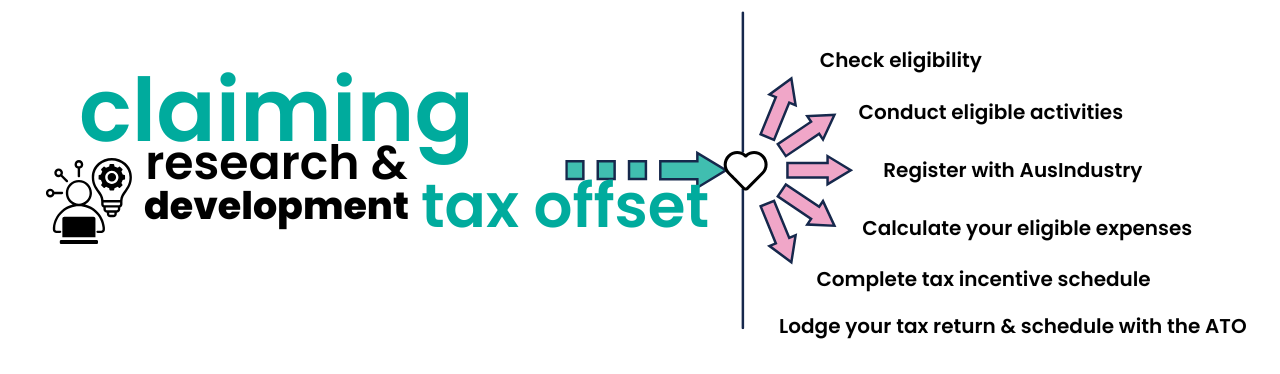

Key steps to claim the R&D tax offset:

- Check eligibility - Make sure your company and activities meet the R&D requirements.

- Conduct eligible R&D activities - Your work needs to involve experimentation, uncertainty, and a systematic approach.

- Register with AusIndustry - You must register before lodging your company tax return and within the required time frame.

- Calculate your eligible R&D expenses (called notional deductions).

- Complete the R&D tax incentive schedule in your company tax return using your registration number.

- Lodge your tax return and schedule with the ATO.

Keeping Good Records

Good records are the backbone of a successful R&D claim. You should keep evidence that shows:

- What activities you conducted,

- Why those activities were experimental,

- How much you spent, and

- How your R&D expenses link to your eligible activities.

This includes things like project reports, time-tracking documents, and evidence of expenditure. Records should generally be kept for at least five years. You can check the full list of requirements here.

A friendly reminder: The R&D tax offset can be incredibly valuable especially for companies investing in development and innovation, but it’s one of the more complex offsets to get right. You’re dealing with technical eligibility, registration requirements, and detailed calculations, which is why many companies use an R&D specialist to help prepare and lodge the claim.

4. Digital Games Tax Offset

If your company is developing digital games in Australia, the Digital Games Tax Offset (DGTO) could be a major bonus for your tax return. This offset is part of a government initiative to help grow and strengthen Australia’s digital games industry by giving eligible game developers a refundable tax benefit based on how much they spend on development.

Benefits of DGTO:

- It allows eligible companies to claim a refundable tax offset equal to 30% of qualifying Australian development expenditure (QADE) on a digital game.

- The expenditure must be certified by the Minister for the Arts as qualifying, and it must be incurred on or after 1 July 2022

- Because it’s refundable, a company can receive the benefit even if it ends up with no tax payable in that year. The ATO will refund the difference.

To be eligible in an income year, your company must:

- Be an Australian resident company with an ABN, or a foreign company with a permanent establishment in Australia with an ABN

- Obtain one or more certificates from the Minister for the Arts stating your eligibility and total QADE for that year

- Claim the DGTO in your company tax return for the same income year.

Types of certificates:

The Minister for the Arts can issue different kinds of certificates depending on the game development activity:

- A completion certificate for a new game finished in the income year.

- A porting certificate when a game is adapted to a new platform.

- An ongoing development certificate for updates or maintenance on existing games.

Once you have your certificate from the Minister for the Arts, you can claim the DGTO in your company tax return under the refundable tax offsets section for the relevant income year.

Minimum spend and cap:

- Your company must have at least $500,000 of qualifying Australian development expenditure on a game to be eligible for a certificate.

- The offset amount is capped at $20 million per company (or group of connected companies) per income year which roughly equates to spending about $66.7 million in eligible development costs to reach the maximum.

A friendly reminder: The DGTO is a great incentive if your business is in the digital games space, but it has specific rules and eligibility requirements especially around the types of games, how development costs are counted, and the need for certification.

Tax offsets for companies might not be as numerous as those for individuals, but they can still make a big difference to your tax bill. From franking credits to foreign income offsets, R&D incentives, and even the digital games tax offset, there are a handful of opportunities that can help your company keep more of what it earns while encouraging growth and innovation.

Some of these offsets can get a little complex, but don’t stress, your accountant is your best ally in making sure everything is claimed correctly and you don’t miss out on any benefits.

Know your offsets, claim them right, and let these little helpers give your company a tax-time boost!

References

- Utilising franking tax offsets and effect on losses – corporate tax entities

- Franking deficit tax offset calculations, reduction rule and exclusions

- Who must lodge a Franking account tax return?

- Eligibility and rules for the FITO

- Calculate your FITO or offset limit

- When a FITO applies

- Research and development tax incentive (and sub articles)

- Assess if your R&D activities are eligible for the R&D Tax Incentive

- Records to show eligible R&D activities for the R&D Tax Incentive

- Digital games tax offset

- Digital games