Not All Heroes Wear Capes – Some Are Disguised as Tax Offsets

Part 1: Tax Offsets for Individuals

Have you ever calculated your tax payable and thought,

“Wait… this is lower than I expected!”

That’s the magic of tax offsets – one of the nicer surprises in taxation, like little bonuses hidden in the system.

Tax offsets and tax deductions are a bit alike – but not exactly the same.

When we calculate your tax, we look at taxable income and figure out how much tax is owed. To calculate the taxable income we calculate: assessable income minus allowable deductions = taxable income.

Tax deductions reduce your taxable income. The bigger / more deductions, the lower your taxable income, so less tax to pay.

Tax offsets on the other hand, come directly off the tax bill. Tax offsets can differ from person to person. Some offsets are refundable, meaning you can actually receive the amount as a refund if it exceeds your tax payable. Others are non-refundable – they can reduce your tax payable to $0, but won’t give you a refund beyond that.

Basic example:

$50,000 assessable income

(-) $10,000 allowable deductions

= $40,000 taxable income

= $4,288 (excluding any offsets)

If you find another tax deduction of $1,000…

$50,000 assessable income

(-) $11,000 allowable deductions

= $39,000 taxable income

= $4,108 (excluding any offsets)

Then, in this case, you are in the Low Income bracket so an offset does apply:

= $39,000 taxable income

= $4,108 usual tax bill

(-) $625 Low Income Tax Offset

= $3,483 actual tax bill you need to pay

Okaaaaay… time to get familiar with the different tax offsets that could be waiting for you – the little helpers that can reduce your tax bill and maybe even give you a nice surprise at tax time!

1. Private Health Insurance Tax Offset

If you’ve got private health insurance, you might get a little tax reduction. The Private Health Insurance Tax Offset (or rebate) can help reduce the tax you owe, making it one of those ‘pleasant surprises’ at tax time.

How it works:

- The amount depends on your income and your type of cover (single, couple, or family).

- It can reduce your tax payable.

This offset is non-refundable. It can bring your tax bill down to $0, but it won’t hand you extra cash. Most of the time health funds report to the ATO that you pay private health insurance, so it’s already filled in for you in your tax return through the ATO Pre-filling Report.

The private health insurance rebate isn’t a fixed rate – it can change each year, usually starting 1 April. There’s no need to stress about updating anything yourself when rates change, unless you expect your income to change during the financial year.

- If you’re getting the rebate as a premium reduction, your insurer automatically updates the percentage and adjusts the amount on your policy.

- If you claim it as a tax offset, the ATO will use the latest rebate rate when processing your tax return to make sure everything is accurate.

Tip: Double-check your health fund details against your tax return. A quick check ensures you don’t miss out on your tax-offset benefit. Read more here.

2. Superannuation‑Related Tax Offsets

Superannuation does not only play a role in your retirement plans, there are a few tax offsets linked to it that might help reduce your tax bill. These tax offsets are designed to reward certain retirement income streams, or help families who support each other’s retirement savings: like paying for super on behalf of your spouse (married or de facto).

2.1 Super Income Stream Tax Offset – For Retirement Income

When you receive a regular income stream from your super, you might be eligible for a tax offset on that income.

What it does:

- You may get a 15% offset on the taxed element of your super income.This will be included on your PAYG payment summary – superannuation income stream.

You generally can’t claim this offset for super income received before reaching your preservation age (60 years old) – unless it’s a disability or death benefit stream, or the person died after they turned 60 years old.

- You may also get a 10% offset on the untaxed element, up to a limit:

- $11,875 for the 2023–24 and 2024–25 financial years

- $10,625 for the 2021–22 and 2022–23 financial years

- $10,000 for the 2020–21 and earlier financial years

2.2 Spouse Contribution Tax Offset – Helping Your Partner’s Super

If you make a non‑deductible super contribution for your spouse (married or de facto), and their income is under $40,000, you might be able to claim a tax offset for it:

How it works:

- You could get up to a $540 tax offset if you contribute at least $3,000 and your spouse’s income is $37,000 or less.

- If your spouse earns between $37,000 and $40,000, you’ll only get a partial offset.

This is a nice way to support your partner’s retirement savings and reduce your tax at the same time.

2.3 Low income super tax offset (LISTO)

You may be eligible for the Low Income Super Tax Offset (LISTO) if you earned $37,000 or less during the year. Unlike other tax offsets, this one does not reduce your tax payable. Instead, the ATO pays the offset directly into your super fund.

There’s no need to apply for LISTO, but you do need to make sure that you:

- Provide your TFN to your super fund, and

- Lodge your tax return, so the ATO can calculate the offset correctly.

The maximum LISTO amount is $500, which can be a helpful boost to your retirement savings.

2.4 Veterans' super (invalidity pension) tax offset

The veterans' superannuation (invalidity pension) tax offset (VSTO) is a non-refundable tax offset. This tax offset ensures veterans and their beneficiaries don't pay more tax because of the Douglas court decision. It applies from the 2007–08 income year.

3. Seniors and Pensioners Tax Offset (SAPTO)

If you’re a senior or pensioner, you might be eligible for the Seniors and Pensioners Tax Offset (SAPTO) – a non-refundable tax offset that helps reduce your tax payable.

How it works:

- Eligibility depends on your age, pension status, and income.

- The offset amount gradually reduces as your income increases.

- The amount of SAPTO you receive is determined by your income thresholds under SAPTO rules.

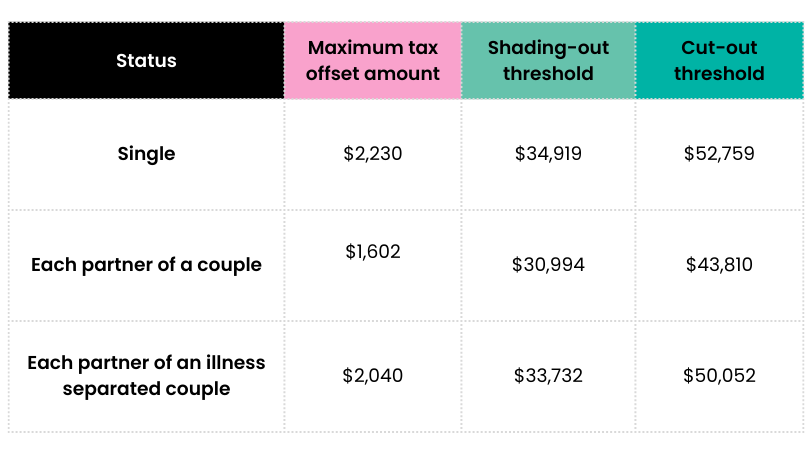

Table from Seniors and pensioners tax offset ATO article

Example

Suzie and Dustin are a couple living together and both receive the age pension. Suzie’s rebate income (the ATO’s term) is $23,000, while Dustin’s is $25,000.

To calculate their SAPTO, two income tests are applied:

- 50% of their combined income, and

- Each individual’s income

Combined income test:

- Total income: $23,000 + $25,000 = $48,000

- 50% of combined income: $48,000 × 50% = $24,000

Since $24,000 is below the cut-out threshold of $43,810, they pass this test.

Individual income test:

- Both Suzie’s and Dustin’s individual incomes are below the shading-out threshold of $30,994.

As a result, both Suzie and Dustin are entitled to the full SAPTO amount of $1,602 each.

Shading-Out Threshold vs Cut-Out Threshold

Shading-out threshold

- The income level at or below which an eligible senior or pensioner receives the maximum SAPTO amount.

- For every dollar earned above this threshold, the SAPTO is reduced by 12.5 cents.

Cut-out threshold

- The maximum income level at which an eligible person can receive SAPTO.

- If income exceeds this amount, no SAPTO is available.

4. Beneficiary Tax Offset

The Beneficiary Tax Offset helps taxpayers who receive certain Australian Government payments and allowances.

These payments and allowances include, but are not limited to:

- Age Pension

- Carer Payment

- Austudy payment

- Commonwealth Prac Payment (CPP) – available from 1 July 2025

- JobSeeker payment

- Youth Allowance

To see the full list of eligible payments and allowances, you can check the ATO’s Government payments and allowances page.

With the Beneficiary Tax Offset, you generally won’t have to pay tax if these qualifying payments and allowances are your only source of income for the year.

5. Offset for Maintaining an Invalid or Invalid Carer

This offset is designed for individuals who care for someone with a disability who is 16 years old or older.

Maintaining an Invalid (Invalid Tax Offset)

You may be eligible to claim this offset if you are the primary carer of a person with a disability and they receive one of the following:

- A Disability Support Pension under the Social Security Act 1991

- A Special Needs Disability Support Pension under the Social Security Act 1991

- An Invalidity Service Pension under the Veterans’ Entitlements Act 1986

Your relationship with the person you care for can be any of the following:

- Spouse

- Child aged 16 years or older

- Sibling aged 16 years or older

- Spouse’s child aged 16 years or older

- Spouse’s sibling aged 16 years or older

- Parent

- Spouse’s parent

Maintaining an Invalid Carer (Invalid Carer Tax Offset)

This offset applies when you are not the main carer of a person with a disability, but you provide care and support to the primary carer instead. In other words, you help look after the carer who is responsible for caring for the person with a disability.

The main carer must be one of the following:

- Your spouse

- Your parent

- Your spouse’s parent

And they must be caring for:

- Your or your spouse’s invalid child aged 16 years or older, or

- Your or your spouse’s invalid sibling aged 16 years or older

To be eligible to claim this offset, the main carer must be receiving either a Carer Payment or Carer Allowance under the Social Security Act 1991.

Just a heads-up: if your and your spouse’s combined income go over the threshold of $117,194 (for 2024–25), this offset won’t be applied to your tax bill.

6. Zone or Overseas Forces Tax Offsets

Zone Tax Offset

The Zone Tax Offset is for taxpayers living in remote or isolated areas of Australia. It helps reduce your tax payable to compensate for higher living costs and limited access to services.

The offset is based on your usual place of residence. Generally, if your address is in a remote or isolated area but you aren’t staying there for more than 183 days in a year (for example, due to work), you won’t be eligible for this offset.

But here’s the good news: if it was your residence for a continuous period of less than five years, you can accumulate the days. Once they add up to 183 days or more, you can claim the offset in the financial year when the total reaches the threshold.

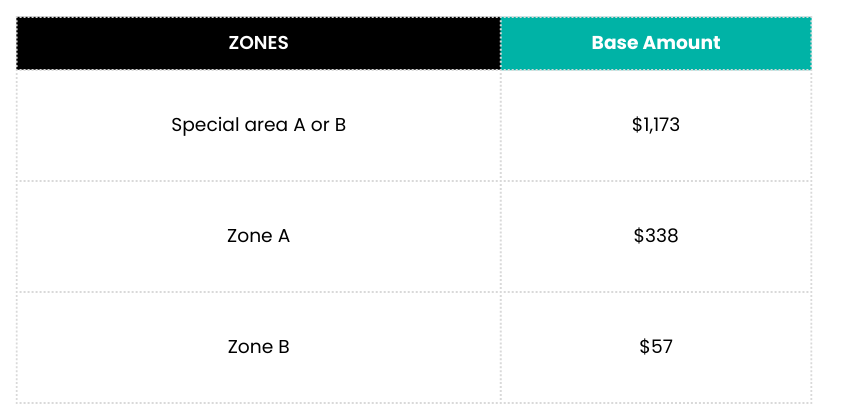

Here are the base zone tax offset amounts:

You can check whether your address falls within a zone using the Australian zone list.

Overseas Forces Tax Offset

This offset is for members of the Australian Defence Forces serving overseas or with a United Nations armed force. It helps reduce your tax payable on income earned while deployed, recognising the service and sacrifices made abroad.

You can claim the full tax offset if you served overseas for 183 days or more in the financial year. If your service is less than 183 days, you can only claim a partial offset.

Unlike the Zone Tax Offset, the days you spend overseas cannot be accumulated across years. The offset is based only on the days served within the same financial year.

7. Claiming a Foreign Income Tax Offset (FITO)

If you’ve paid tax overseas on income you earned abroad, the Foreign Income Tax Offset (FITO) has your back. It helps make sure you’re not taxed twice on the same income – no double-dipping in your taxes! Yeeey!

How it applies:

- FITO reduces the Australian tax payable on your foreign income.

- The offset is capped at the amount of Australian tax that would normally be payable on that income.

Example:

You earned income in the US and already paid tax there. FITO ensures you don’t pay full tax again in Australia – you get a credit for the tax already paid overseas, keeping things fair and square.

8. Low Income Tax Offset (LITO)

The Low Income Tax Offset (LITO) is designed to help low-income earners reduce their tax payable. It’s a simple way for the tax system to give a little extra breathing room to taxpayers.

What you need to know:

- LITO reduces the tax payable directly – not your taxable income.

- The offset gradually phases out as your income increases, so higher earners may not be eligible.

- The amount of LITO you can claim depends on your taxable income:

- The maximum LITO is $700 for those earning $37,500 or less.

- If your income is between $37,501 and $45,000, the $700 offset reduces by 5 cents for every $1 above $37,500.

- For incomes between $45,001 and $66,667, the offset starts at $325 and reduces by 1.5 cents for every $1 above $45,000.

- If your income is above $66,667, unfortunately, you won’t be eligible for LITO.

You don’t need to apply separately as ATO automatically calculates LITO when you lodge your tax return.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

And there you have it – a handy guide to the tax offsets that could give your tax bill a little break. From health insurance rebates to super contributions, low-income boosts, and even offsets for caring or serving overseas, these are the ‘nice surprises’ in taxation that you don’t want to miss.

Remember: tax offsets reduce your actual tax payable, not your income, so they can make a real difference come tax time. Some are refundable, some aren’t, but all of them are worth checking to make sure you’re getting what you’re entitled to.

Take a moment, double-check your eligibility, and claim the offsets that apply to you – every little bit helps, and it’s always nice to keep more of your hard-earned money in your pocket.

References

- About tax offsets

- Military invalidity pensions

- Beneficiary tax offset and seniors and pensioners tax offset calculator

- Government payments and allowances

- Australian zone list