Private health insurance rebate

Rebates anyone?

The answer should be a definite YES! They’re extra tempting when it feels like you’re getting rewarded for spending.

Did you know the Australian Government offers a kind of rebate – not for shopping, but for your private health insurance? Yep, it’s real! It’s called the Private Health Insurance Rebate, and it’s designed to make your premiums a little easier on the wallet.

Think of it as the government’s way of saying thank you for taking out private health insurance. Understanding how the rebate works is a bit of a life hack – it can help you save money and avoid paying more tax than you need to.

What Is the Private Health Insurance Rebate?

The private health insurance rebate is a benefit the Australian Government gives to help make private health insurance more affordable. It’s a discount on your health insurance premiums – or a refund at tax time – depending on how you choose to receive it.

Here’s how it works:

- The rebate amount you get depends on your income and your age.

- The higher your income, the smaller your rebate (and vice versa).

So if you’ve noticed your premium seems a little lower than expected – that’s probably your rebate at work.

Who Can Get the Rebate?

Not everyone automatically qualifies for the private health insurance rebate. Here’s what you need to meet the eligibility requirements, based on ATO guidelines:

- You Must Have a Complying Health Insurance Policy

For your private health insurance to comply, it must:

- Meet the Australian Government’s standards

- Come from a registered Australian insurer

Overseas or non-complying policies don’t qualify for the rebate.

- You Must Be a Private Health Insurance Incentive Beneficiary

This simply means you’re covered by a private health insurance policy and you’re eligible to receive the rebate for it.

- You Need to Be Eligible for Medicare

To get the rebate, you need to be eligible for Medicare – Australia’s public healthcare system that helps pay for doctor visits, hospital stays, and other essential medical services.

If you’re a temporary resident or not covered by Medicare, you usually can’t claim the rebate, even if you have compliant private health insurance.

- Your Income Must Fall Under the Rebate Thresholds

The rebate is income-tested. The higher your income, the smaller your rebate (and vice versa). We’ll unpack the income tiers and rates in a later section.

The ATO uses your income for surcharge purposes – not just your taxable income – to work this out. That includes things like reportable fringe benefits, investment losses, and certain super contributions.

- If Someone Else Pays Your Premiums

Even if another person (like your employer or partner) pays your insurance premiums, you may still be eligible for the rebate. As long as you’re the policyholder or listed beneficiary on the policy.

How Much Rebate Can You Get?

Here’s where things get interesting – your rebate rate depends on two main factors:

- Your income, and

- Your age

Basically, the higher your income, the smaller your rebate. The idea is to give a bigger helping hand to people who need it most.

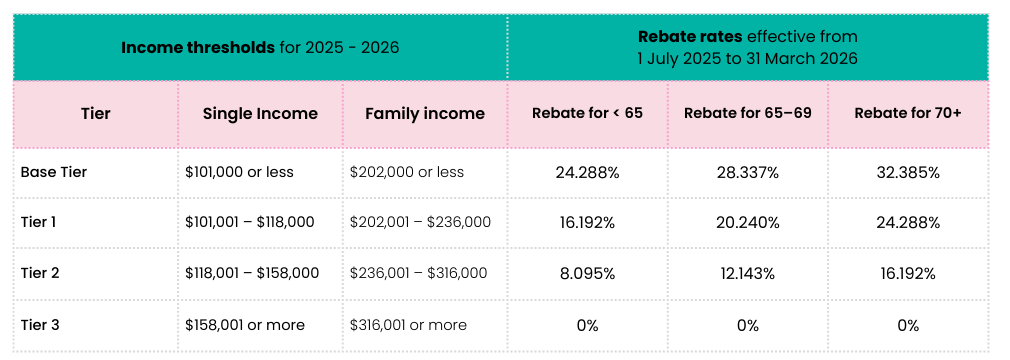

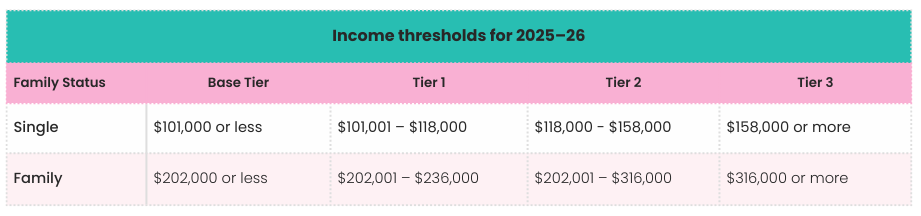

The ATO uses income thresholds to work out which tier you fall under. There are different thresholds for singles and families, and these are adjusted slightly each year.

Below are the 2025–26 thresholds & rebate rates for Australian residents:

Note: The ATO will release the private health insurance rebate rates effective from 1 April 2026 in March 2026.

Example:

Rory earns $120,000 a year and is under 65. This puts her in Tier 2 ($118,001 – $158,000), with a rebate rate of 8.095%.

If her annual private health premium is $3,000, her rebate looks like this:

$3,000 × 8.095% = $242.85

That’s about $243 saved – just for maintaining private cover.

How to actually get a rebate?

Now that you know what the rebate is and whether you qualify, let’s talk about how to actually get it.

The good news? It’s pretty easy! You’ve got two main ways to claim your private health insurance rebate:

- Option 1: Get it upfront through your insurer

You can choose to have the rebate applied directly to your premiums.

That means your health fund automatically reduces the amount you pay, so your monthly or annual bill is lower right away. It’s a popular choice because it’s simple and instant – no need to wait until tax time.

Example:

Dean pays $200 a month for his private health insurance. If he qualifies for a 24.288% rebate, his insurer can apply that discount directly. He only pays about $151 a month instead of the full $200.

Rebate: $200 x 24.288% = $49

- Option 2: Claim it at tax time

Prefer to pay the full amount and sort it out later? You can also claim the rebate as a tax offset when you lodge your annual tax return.

The ATO will calculate the rebate you’re entitled to based on your income, age, and policy details (using info from your private health insurer).

If you’re owed a rebate, it reduces the tax you need to pay or increases your refund.

What If You Claimed Too Much Rebate?

Sometimes people overestimate which income tier they’re in when giving an income estimate to their private health insurer, and end up claiming a bigger rebate than they should.

If that happens, don’t panic – the ATO will sort it out when you lodge your tax return.

They’ll adjust the difference, which may mean you’ll need to repay the extra rebate you weren’t entitled to.

Example:

Lane estimated her income would be $95,000 (Base Tier) and received a 24.288% rebate throughout the year. Her annual private health insurance premium was $2,000, so she received a rebate of $485.76 (24.288% × $2,000).

But when tax time came, Lane’s actual income turned out to be $120,000, putting her in Tier 2, where the rebate rate is 8.095%. At that rate, she was only entitled to a rebate of $161.90 (8.095% × $2,000).

That means she received $323.86 more than she should have.

The ATO recalculates the correct amount, and she pays back the difference – usually as an additional tax liability when she lodges her tax return.

What If You Haven’t Claimed the Full Rebate?

It can go the other way, too! If you received less rebate than you should have, the difference becomes payable on the ATO’s end and will be treated as a refundable tax offset, appearing as a credit on your notice of assessment.

So, either way it all balances out in the end.

Claiming the Rebate for Your Spouse

If you and your spouse share the same private health insurance policy, one of you can choose to claim the rebate for both as long as you:

- Were spouses at the end of the income year

- Were covered under the same complying policy for the same period

- Agree on who will claim before lodging your tax return

If you claim your spouse’s rebate, they can’t claim it again in their own return. You can still do this even if you lodge at different times.

Just remember:

- If your spouse already received part of the rebate through premium reductions, any overclaimed amount will need to be repaid.

- If your spouse is on a separate policy, they’ll need to claim their own rebate.

- If your spouse doesn’t lodge a return, their rebate liability may transfer to you, and

- If you separated during the year, you can only claim your share of the policy.

Example:

Jess and Rory have a joint family policy. Their combined income is $180,000 – which keeps them in the Base Tier, giving them the full 24.288% rebate.

Family Thresholds and Dependents

For families, the income thresholds are double the single rates and they increase by $1,500 for each dependent child after the first.

(Income thresholds and rates for the private health insurance rebate | Australian Taxation Office)

That means bigger families can earn a little more before moving into the next tier.

Example:

A family with two dependent children has a Base Tier threshold of $203,500 (that’s $202,000 + $1,500).

Prepaid Premiums and Multiple Adults on a Policy

If you like paying your private health insurance ahead of time, maybe to lock in a rate or just tick it off your to-do list, that’s called prepaying your premium.

Here’s the catch: your rebate is based on when you pay, not when your cover actually applies.

So, if you pay a full year’s premium in June 2025, your rebate counts for the 2024–25 income year, even though your cover might extend well into 2025–26.

And if there are two or more adults on your policy, the rebate rate is determined by the oldest person covered.

Example:

Dean (34) and Lane (68) share a family policy. Even though Dean is under 65, the rebate rate follows Lane’s age bracket (65–69 years) – so they get 28.337% under the Base Tier.

Annual Rebate Adjustment

The private health insurance rebate isn’t a fixed rate. It can change every year, usually starting 1 April. But there’s no need to stress about updating anything yourself.

- If you’re getting the rebate as a premium reduction, your insurer automatically updates the percentage and adjusts the amount on your policy.

- If you claim it as a tax offset instead, the ATO will use the latest rebate rate when they process your tax return to make sure everything’s accurate.

You don’t need to contact your insurer when the rates change, but you can if you think your income this year might place you in a different rebate tier. For instance, if you expect to earn more (or less), letting your insurer know early helps ensure your rebate stays accurate. This can save you from unexpected additional tax payable at tax time – especially if your income is likely to increase during the year.

Lifetime Health Cover (LHC): What It Is and Why It Matters

If you’ve ever wondered why people keep saying, “Get private health insurance while you’re young,” this is why – to avoid Lifetime Health Cover (LHC) loading.

LHC is a government initiative designed to encourage Australians to take out private hospital cover earlier in life – ideally before turning 31 – and to keep it. The idea is simple: the younger you are when you get covered, the cheaper your premiums will be in the long run.

LHC loading is basically an extra cost added to your private hospital cover if you wait too long to get it.

Here’s how it works:

- If you get private hospital cover before July 1 after you turn 31, you’ll be locked in at the standard (base) rate – meaning you won’t have to pay any extra LHC loading later on.

- If you wait until later, you’ll pay a 2% loading on top of your premium for every year you’re over 30 when you first get hospital cover.

- The LHC loading can only go up to 70%, no matter how late you get hospital cover. There is a silver lining – after 10 straight years of keeping your cover, that extra cost disappears completely.

Example:

Logan took out hospital cover at age 35 – that’s five years past 30. Because of that, he pays an extra 10% loading on his premiums (2% × 5 years).

The good news? Once Logan keeps his hospital cover for 10 continuous years, the LHC loading is removed – as long as he doesn’t let his policy lapse for more than 1,094 days (roughly three years).

LHC Loading - a Few Exceptions

There are a few situations where you won’t be charged LHC loading, even if you took out hospital cover later in life.

You don’t have to pay the LHC loading if:

- You were born on or before 1 July 1934.

- You’re a new migrant to Australia and took out hospital cover within 12 months of registering for Medicare.

- You had approved overseas health cover while living abroad.

- You’re a member of the Australian Defence Force and entitled to free medical care.

- You’ve been covered under a Department of Veterans’ Affairs Gold Card.

LHC and the Private Health Insurance Rebate

If your policy includes an LHC loading, your rebate applies only to the base premium — not to the extra loading you’re paying on top.

Example:

Marty’s hospital cover costs $1,000, but because of a 10% LHC loading, he pays $1,100 in total. His rebate, however, is only calculated based on the $1,000 base premium, not the additional $100 added due to the loading.

Private Health Insurance Statement

Before lodging your tax return, take a moment to review your Private Health Insurance Statement. This annual summary from your insurer shows how much you paid for your health cover and how much rebate you’ve already received throughout the year.

You’ll usually receive your statement directly from your health insurer, either by email, post, or through your online member portal. In most cases, your insurer also sends this information straight to the ATO, so it should appear pre-filled in your myTax account when you start your return.

If you use a registered tax agent, they’ll have access to the same data through their lodgment software, but it’s still a good idea to keep your own copy for reference.

Details to watch out for

Your statement includes key figures that the ATO uses to calculate your rebate:

- Policy ID – the unique code for your health cover.

- Tax Offset Amount – the rebate amount applied to your premiums.

- Number of Days Covered – the total days you held your insurance during the financial year.

If you share a policy with your spouse, you’ll each receive your own statement showing your respective share of premiums and rebate entitlements.

Always double-check that the information on your statement is correct – especially your name, policy ID, and coverage period. If something looks off, contact your insurer before submitting your return. Small errors can affect your rebate calculation or cause adjustments later on.

Special Notes for Overseas Visitors and Students

If you’re an overseas visitor or student in Australia, your private health insurance situation can be a little different and not all policies will qualify for the rebate.

-

If You Have an Overseas Health Insurer

- Health cover from an overseas insurer is usually not eligible for the Australian private health insurance rebate. The rebate only applies to policies issued by registered Australian health insurers.

-

If You’re Not Eligible for Medicare

- You can’t claim the rebate if you’re not entitled to Medicare benefits. This applies to most temporary visa holders, unless you’re from a country with a reciprocal health care agreement with Australia.

-

Complying Policy Exception

- In some cases, overseas visitors or students who hold Overseas Visitors Health Cover (OVHC) or Overseas Student Health Cover (OSHC) may qualify for the rebate – but only if their policy is recognised as a complying health insurance policy under Australian law. It’s best to confirm this directly with your insurer.

When completing your tax return, include your private health insurance details only if your insurer is registered with the ATO and provides a statement. If your policy doesn’t qualify, you can simply leave this section blank – there’s no rebate to claim or report.

Quick Recap:

Here’s a quick checklist to keep things simple:

- Make sure your policy is a complying Australian health insurance policy.

- Check your income tier and age group to know your rebate rate.

- Keep your Private Health Insurance Statement handy. It’s your key reference for tax time.

- Review your statement each year before lodging, and let your insurer know if anything looks incorrect.

- Remember: income thresholds and rebate rates change over time, so it’s worth double-checking every financial year.

And if you’re unsure about your eligibility, how to claim, or whether your policy qualifies – don’t stress. A registered tax agent can help you make sure everything’s correct, so you receive the rebate you’re entitled to.

Case Study: When the Rebate Turns Into a Surprise Bill

Sookie, a freelance designer, had a stellar year – her business income shot up 72% compared to last year. She was feeling confident and expecting a nice refund when tax time rolled around… until her tax agent shared the news: she actually owed more tax than she’d set aside.

So, what happened?

Throughout the year, HCF, her private health insurer, had been applying the Base Tier rebate rate of 24.288% to her premiums – the same as last year. But with her income growing so much, Sookie had moved up into Tier 2, where the rebate dropped to just 8.095%.

That difference meant the rebate she’d already received was more than she was entitled to, and the ATO added an “Excess private health insurance entitlement” of $498.01 to her tax bill.

Add to that the fact that her PAYG instalments were still based on last year’s lower income leaving her $2,100 short on tax payments and suddenly, that expected refund had flipped into an amount payable.

Higher income = smaller rebate + higher tax.

The good news? It’s all fixable. Sookie can update her income estimate with HCF so her rebate percentage aligns with her real earnings. Her premiums may go up slightly, but it means no surprise bills next tax season and smoother cash flow all year round.

Takeaway: A growing business is worth celebrating – but it’s also your cue to give your insurer and the ATO a quick update. Updating your income estimate early can save you from those “Wait, what?!” moments later.

Getting your head around the private health insurance rebate doesn’t have to be a headache. A little know-how can go a long way in boosting your refund (or at least avoiding those surprise adjustments later on). Whether you’re checking your eligibility, reviewing your income tier, or confirming your policy details, a few minutes of preparation can save you a lot of confusion down the track.

Think of the rebate as a friendly nudge from the government to help make private health cover a little lighter on the wallet – but it only works its magic if your details are up to date. If all this still feels a bit ‘too taxy’, don’t worry – a registered tax agent can step in to make sure everything’s accurate and stress-free, so you can lodge with confidence (and maybe even smile when you see that extra tax offset come through).

Sources | References: