Super Changes 2022

What is super?

‘Super’ is just short for superannuation. You can get more information on super in our blog if you need.

What has changed?

There are a few changes effective from 1 July 2022, but there are two key changes relevant to our clients:

1. The amount of the super guarantee (the % of contribution your ‘employer’ has to make) has increased. It was 10%, it is now 10.5% (woohoo!). This is going to continue going up…

FY2023 = 10.5%

FY2024 = 11.0%

FY2025 = 11.5%

FY2026 = 12.0%

For the employers, this means allocating more in the budget over time to cover superannuation for employees (and maybe for subcontractors).

2. In the past, you only had to make a super contribution, as an employer, if your employee earned over $450 in a month. What this means is that from 1 July 2022, if the employee earns $1 or $500 or whatever in a month, then super needs to be paid on those earnings. If the employee is under 18 years they are not entitled to the super, unless they work more than 30 hours/week.

One big impact of this, is that we’re now talking more about contractors being deemed to be ‘employees’ for the sake of super. It means even if people are not technically employed, the terms of the arrangement might create the same obligations as if they were employed - the ‘employer’ may have a legal obligation to pay super to the superfund of the sub-contractor. This is something that will impact all industries, and comes with pros and cons (we’re pretty on board with people growing their super), but is really set to impact the performing arts and SW industries (which affects a lot of our clients).

So, we’re going to break it down for you here. This should then be a resource to refer back to, and to share amongst your own networks, or with your ‘employers’ and ‘employees’ (sub-contractors).

Do you need to pay super for this employee / subcontractor?

The magic question! The ATO has heaps of info on this here. For the sake of this blog, we’re focusing on standard employee and then subcontractor type arrangements.

Super and the Arts

Superannuation legislation has some special rules that apply to people working in the arts industry (which is most of our clients). It deems these people to be employees for the purposes of super, irrespective of the above:

- People paid for performance or presentation of any music, play, dance, entertainment, sport, display or promotional activity;

- Persons paid to provide services in connection with the above activities (tech, sound etc.); and

- People paid to perform services in connection with the making of any film, tape or disc or of any television or radio broadcast.

From the legislations:

Subsection 12(8) of the SGAA defines ‘employee’ to include: (a) a person who is paid to perform or present, or to participate in the performance or presentation of, any music, play, dance, entertainment, sport, display or promotional activity or any similar activity involving the exercise of intellectual, artistic, musical, physical or other personal skills is an employee of the person liable to make the payment. 84. One clear limitation on these words is that the active participation of the artist or sportsperson is required. If not, it could not be said that the person is ‘paid to perform or present’ the activity. A painter, for instance, does not perform or present a painting exhibition.

A person engaged to write a script is performing services but one who sells existing scripts is not – they are merely selling property.

A technician engaged to control the sound quality for a concert is not an active participant in any performance. Even though the technician is not within paragraph 12(8)(a), they are still an employee because they are paid for services in connection with a musical performance.

If you fit these, then you are entitled to super payments, even if acting as a subcontractor.

In the arts but not involved with performance? It is currently not legislated that visual artists or graphic designers etc. be paid superannuation on the artist fee, commission for work or exhibition - but, the gallery or customer may be generous and choose to pay it anyway.

If you work as a contractor in the broader arts or other industries, you might still be entitled to super from your ‘employer’. Read on…

Super for other subcontractors (beyond the arts)

Sometimes you might be a subcontractor (sole trader with an ABN for example) but be deemed to be like an employee for super or tax purposes. This basically means the ‘employer’ (your customer / person or business engaging your services) has the same obligations they’d have if you were an actual employee… meaning, they need to pay your super!

The ATO says the ‘employer’ has to pay super for the subcontractor if they pay the subcontractor:

- Under a written or or verbal contract that is mainly for their labour (more than half the dollar value is for their labour)

- For their personal labour and skills (payment is not dependant on achieving a specific result)

- To perform the contract work (i.e. subcontractor cannot delegate it to someone else to do in their place)

If the ‘employer’ engages the services of a Trust, Company or Partnership though (i.e. not a sole trader) then the ‘employer’ does not have to pay the super of the person who that entity (Trust, Company or Partnership) ends up paying to do the work.

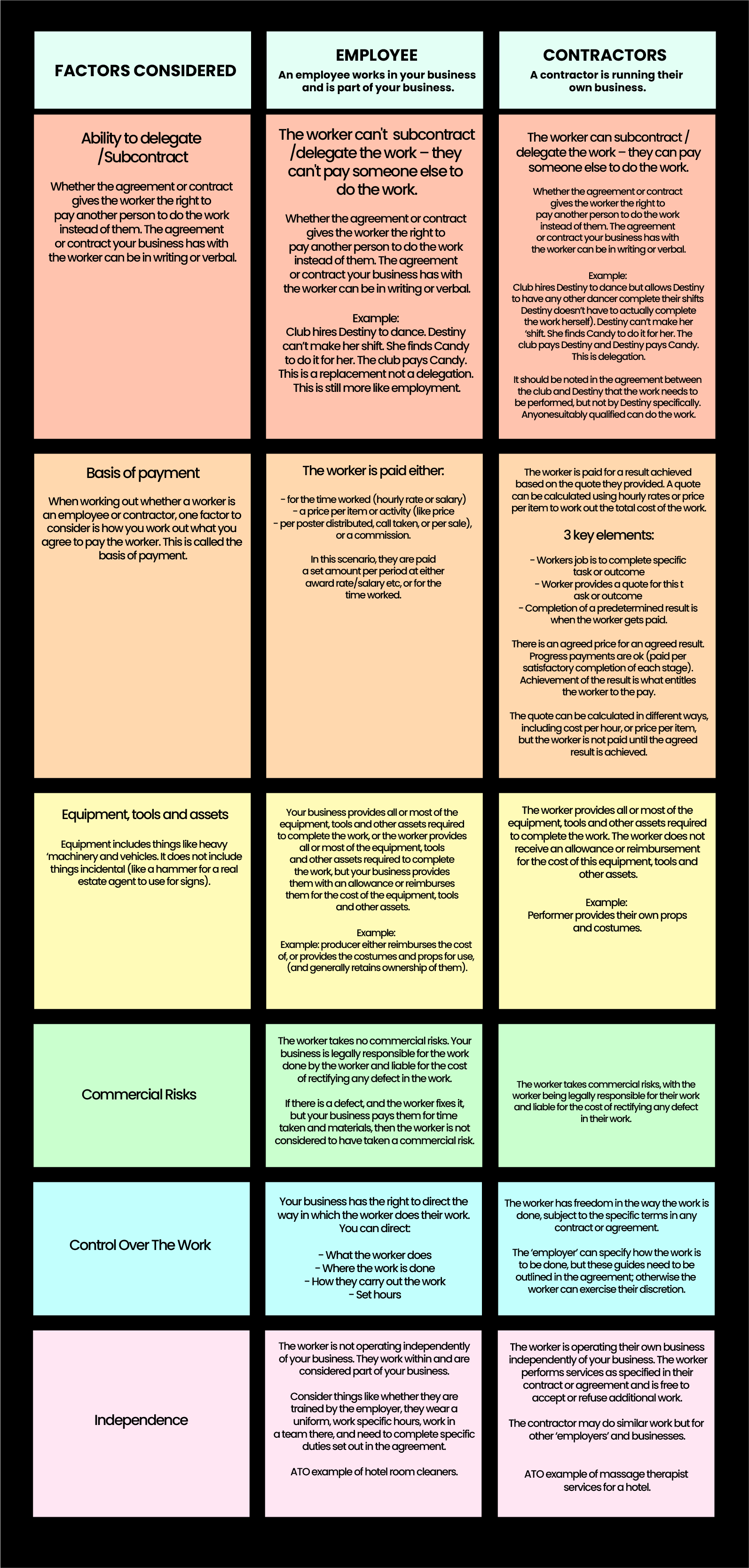

There are six key factors, considered together, to determine whether the worker is an employee or a subcontractor - ATO info here.

Look at each individual employee or sub-contractor in their own right and in respect of each role or job they do for you.

A few key things:

- If you are self-employed (sole trader) you don’t have to pay super for yourself, but you might want to - check out this blog we wrote on making your own contributions.

- Also, if you are self-employed and think your customers (like employers) should be paying super for you then read on!

- Generally speaking, all employees are entitled to super payments calculated as a % (check table for rate for each year), on ordinary times earnings (i.e. not on overtime earnings and other things). The ATO has some info on ordinary times earnings here.

- If your employee is under 18, (from 1 July 2022) you must pay super guarantee on payments you make to them if they work for you more than 30 hours in a week no matter how much $$ you pay them for those hours.

- Your worker is eligible for super even if they are a temporary resident, such as a backpacker or a working holiday maker. However, you do not have to pay super for non-resident employees who work outside Australia.

TOOLS:

- USE THIS TOOL to figure out if the worker is an ‘employee’ for super purposes.

- Then USE THIS TOOL to confirm if you need to make super contributions for your worker.

If you are the sub-contractor and want to figure out if your ‘employer’ should be paying your super you can USE THIS TOOL to help. Then print screen the results to show them or to discuss with your accountant. - Then finally USE THIS TOOL to help you calculate how much super to pay (if any).

Based on the above, do you need to pay super?

If not, then don’t worry about the rest of this blog to be honest.

If yes, strap in.

How much to pay?

The ‘employer’ needs to pay the super guarantee percentage (10.5% for FY2023) of the workers ‘ordinary time earnings’ - this is the labour component of the contract. Do not include

- Any contract payments for material and equipment

- Overtime for which they were paid overtime rates

- GST

Example: performer charges $150+GST for a comedy spot, they would be entitled to $150 x 10.5% = $15.75 of super paid to their superfund. If they charged $50 for bringing their own mic, that would not result in any extra super payable.

You can USE THIS TOOL to confirm the amount payable, and then print the result for your records.

Important: Paying an additional amount equal to the super guarantee (SG) rate to the contractor on top of their usual pay does not count as a super contribution. To avoid the SGcharge, you must make the SG contribution to the contractors’ super fund each quarter.

When to pay? (due dates)

Super payments are due quarterly but you can make the payments more frequently.

Here is the table of quarterly due dates:

If you have missed the quarterly payment due date or made late super payments, you will need to lodge a superannuation guarantee charge (SGC) statement and pay the SGC to the ATO. The missed or late super payments are no longer tax deductible.

Let’s all just do the right thing and pay super when due, but in case you don’t for whatever reason, here is some info on the extra charges you will need to pay - ATO info here.

Getting set up (employers read this!):

The employer needs to make the super payment to the employee’s superfund or a stapled fund (more information on stapled funds below), or to your default fund (as employer) if they did not make an election themselves. It should NOT be paid to the employee directly for them to contribute themselves. Read the ATO info here about where to pay the super.

Forms to give your employee:

- Standard choice super form here and info about it here

- Authority to provide TFN to superfund here OR Tax Declaration form here

- Bank account form

- Print this clearing house info and give to your employee here

- (optional) Request for stapled superfund details form here

You can make your own pretty versions but they do need to have the same exact info and fields on them to be compliant.

As the ‘employer’ you need to make the super payments. Here’s how:

- Most employees will have a preferred fund, but just in case they don’t, you need to have a default fund - read more here and look up superfunds here. You give the employees the details of the default fund in section B of the form.

- You need to offer employees a choice of fund and you must give them the standard choice form (or an equivalent) within 28 days of their employment starting. Here is a copy of the template form. Remember to put your default fund info in section B.

- Hot tip: employees can complete pre-filled standard choice forms in MyGov > ATO services and then just print that and give to each employer when needed

- Be careful: if you are not a ASIC registered financial advisor then you cannot advise your employee on things like: how much to contribute to super, which superfund to choose, or how to consolidate super. Recommend that they speak to a professional instead if they need help or have questions. Read here about what you can and cannot say.

- If employees need help choosing a fund you cannot advise them, but you can suggest that they use this tool to figure it out themselves.

- Record keeping: keep a Google Drive folder for employee/contractor related files like contracts, performance reviews and super and tax docs. Make sure it is secure, and that you keep everything for 5 years. For super you need to keep note of:

- How much super you paid

- How that amount was calculated

- The fact you offered each employee a choice of super fund (save pdf of the email and their form for selection)

- Details of employees not eligible for super

- You can then give the employee’s tax file number (TFN) to their nominated superfund - read more here.

- In the contract you have with them

- Through a tax declaration form

- Or by using a special authority form here

- You need to make sure the employee has given you permission to do this otherwise you can be penalised. Get the permission either:

- Check that the fund you are paying into is a complying super fund. Only payments to a complying fund count! You can double check by looking up the superfund up here.

- You can then make the payments into either the nominated superfund, a stapled fund, or your default fund for that employee.

- A stapled fund is an existing super account which is linked (stapled) to that individual employee so it follows them when they change jobs. Read up on them here. If an employee doesn't nominate a superannuation fund for SG contributions to go into, you, the employer, must make enquiries of the ATO as to whether the employee has a stapled fund. These are also great to use when including contractors you pay mainly for their labour and who are employees for SG purposes, or when they are temporary residents.

To use a stapled fund:

- First you must offer them the opportunity to make a choice of superfund (i.e. give them the standard choice form). If they don’t make a selection, then you proceed to the next steps in order to request the info about their stapled fund.

- Establish an employment relationship. You can request your employee’s stapled super fund details after you submit a Tax file number declaration or Single Touch Payroll (STP) pay event, which identifies that you have an employment relationship or link to your employee. For employers using Xero, this happens when you set up the new employee and complete and ‘file’ the ‘tax’ screen for that employee.

- When you submit the request, you need to include:

- Topic: Superannuation

- Subject: Other

- Description: include reference to ‘Stapled super fund request for contractor’

- The written contract signed by both parties for the contracting arrangement. Yes this means you need a written contract for all sub-contractor arrangements.

- A completed and signed Contractor stapled super fund request form.

- If you are looking to pay super to a stapled fund for a sub-contractor then the above STP or tax declaration option won’t apply because they won’t be in your systems necessarily. You need to request a contractor’s stapled super fund details using the secure mail function in ATO online services. Log into Mygov > ATO > Find the secure mail section (this is sort of how you email the ATO).

- If you are an employer of employees (rather than sub-contractors) and you have completed step 2 above) then you can do the request through ATO online services for business.

- TFN – an exemption code can be entered where an employee can't provide their TFN, but this could result in processing delays

- full name, including ‘other given name’ if known

- date of birth

- address (residential or postal), if TFN not given.

- Click here to access. Log in.

- Navigate to the 'Employee super account' screen via the 'Employees' menu and select 'Request' to open the form.

- Enter your employee's details, including their:

- Read and click the declaration to sign it. You can tick a box under 'more employees to request?' to request stapled super fund details for additional employees.

- Submit your request.

If you're unable to access online services, contact the ATO on 13 10 20 (or +61 2 6216 1111 for overseas callers) to request details of a stapled super fund.

Now you have the info you need to be able to do the super payment.

How to actually make the super payments (to the super fund):

The ATO has all the detailed info here but we’re going to break it down for you!

SuperStream

SuperStream is the way all employers must pay employee superannuation guarantee contributions to super funds. With SuperStream, money and data are sent electronically in a standard format. Your employee super information is linked to your super contributions by a unique payment reference number (PRN). This means you can make all your super contributions in a single transaction, even if the payments are going to multiple super funds.

The ATO outlines these options and the details here.

There are a few ways to make the payments:

- Payroll system

- If you use Xero or Quickbooks and have a subscription level sufficient to handle payroll, then you can potentially manage the super payments and reporting through here for contractors and employees. Some software lets you process super payments within and will direct debit your account for the money, which will then be paid to each employee’s respective fund. Other software will process it ‘on paper’ but you need to physically make the bank payments to each fund yourself.

- Superfund online system

- Large super funds have online payment services you can use.

- Super clearing house (our recommendation)

- More info here on this one! A clearing house pays super to your employees' super funds for you. You send a single electronic payment to the clearing house with all your employees' super contribution data, and the clearing house does the rest.

- There is a [free] Small Business Superannuation Clearing House where you can choose this option if you have either: 19 or fewer employees, or a turnover of less than 10 million dollars. That is pretty much all of the clients we work with.

- The clearing house is accessed via the ATO's Online services for business, Online services for agents or ATO online services in myGov.

- EFT or Bpay direct to fund

- If you pay directly to a super fund with EFT (direct credit or direct debit) or BPAY, you must also send the employees information electronically (not by email). Direct contributions can only continue with special agreement from each of your super funds. Contact your fund to see if direct contributions can continue or if any changes are required.

You must send the payment and data on the same day. This lets the super fund match your payment and information and allocate the contribution to the fund member's account.

Setting up the clearing house

Here are the things you will need to have ready:

- Info about you, your business and ‘employees’

- Your employee’s choice of fund

- Your default fund

(If you have a bookkeeper doing the work for you then you also need their info so you can set them up as an authorised representative).

If you are a Company, Trust or Partnership type employer:

- Access the online business manager here.

- Select Employees > then select Small Business Clearing House

You should be able to log in using your MyGov ID. If you are new here, then you might need to first connect your business account with your MyGov ID (especially if you are a Company, Trust or Partnership type employer). Access the Relationship Manager here to do that step.

If you are a Sole Trader or Individual type employer:

- Log into MyGov normally > ATO services

- View and manage Super in there (under Super Clearing House) - you will need to set this up the first time you do it.

Now, you’re in, you can process super and make payments:

- Work out how much super you need to pay for all your employees.

We can provide or create a special spreadsheet for you if you need a hand! - Access the clearing house through Online services for business or ATO online services.

- Enter instructions about how to distribute payment to each employee's super fund, noting the payment reference number (PRN).

- Make a single electronic payment to the clearing house for all your employees including the PRN.

- The clearing house distributes the payment to each employee's super fund according to your instructions.

The ATO have created this handy checklist for you here.

Overwhelmed? Yeah, we feel that too.

We have made a handy spreadsheet for our clients (email for access!), which should help you make sure you have ticked everything off and kept your records in order.

Yell out if you get stuck!

Tax Deduction

If you are the employer in this situation, then the amount you pay to your employee/ subcontractor is likely a tax deductible expense, and the amount you pay to their superfund (as Super Guarantee contribution) is also a tax deduction.

The subcontractor includes only their ordinary earnings in their tax return as taxable income. The super part (paid direct to their superfund) is not taxable income so does not get reported to the ATO in the tax return.

If the employer pays more than the applicable super guarantee % set by the ATO (i.e. if they pay 15% instead of the 10.5%), then the additional portion may be taxed differently (chat to your accountant!).

Example: Pay the subcontractor their $100 directly (claim as deduction) and pay the $10.50 to their superfund (also claim this) = $110.50 total deduction for you. The subcontractor will declare the $100 as income.

If you have more questions you can reach out to us here at The Real Thiel anytime, book a consult, or maybe reach out to an Arts Lawyer - some resources here with Arts Law and here with Creative + Business.

You might also like our Superannuation Video covering everything you need to know, in heaps of depth.

Just remember, we think you’re super!

Xxx Lauren

https://visualarts.net.au/media/uploads/files/Factsheet-SuperObligations_3.pdf