Structures

Choosing the Right Business Structure For You

Starting a business is exciting. You've got the idea, the passion, and the drive. But before diving headfirst into branding, design, or building your dream workspace, there’s a less glamorous yet critical decision to make: your business structure.

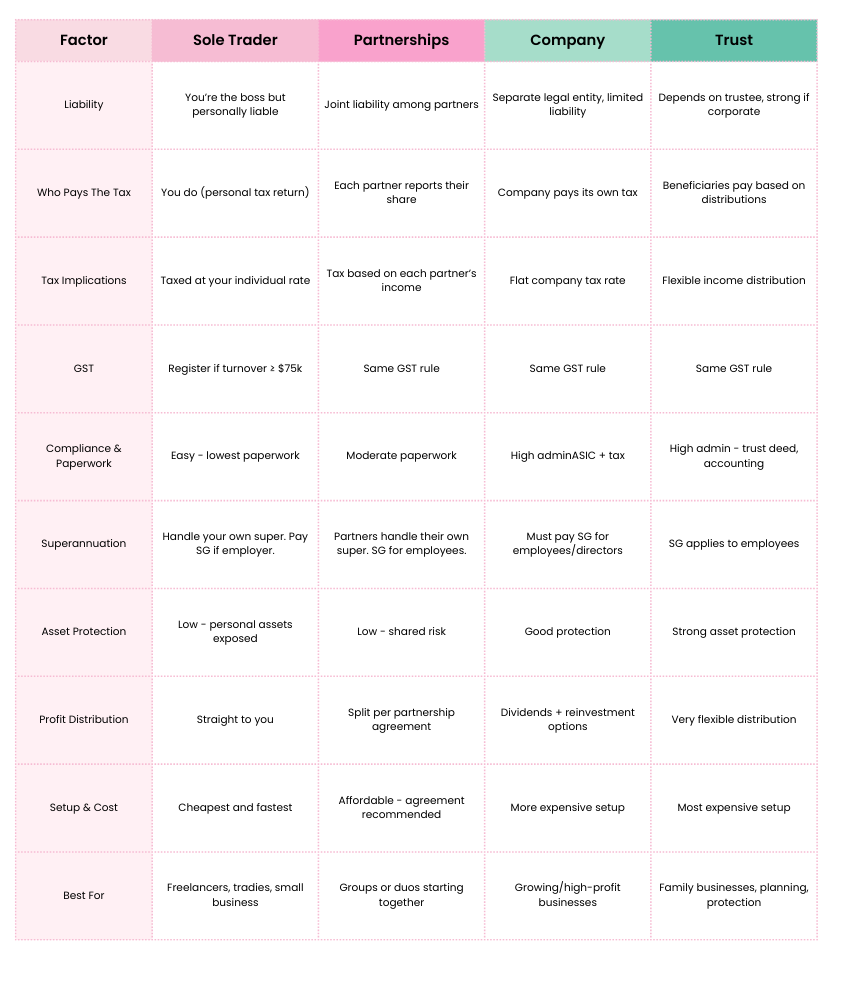

The structure you choose will affect everything. From how you pay tax, to your personal liability, and how easily you can bring in investors. So, whether you’re a solo creative, a small agency, or a group of friends launching something big, let’s explore business structure options in laymen’s terms.

1. Sole Trader

Think of a sole trader as a ‘one-person show’. YOU ARE the business. Simple, flexible, and affordable to start. This structure suits freelancers, photographers, solo designers, or consultants testing the waters.

Pros:

- Easy and inexpensive to set up - just register an ABN for free with ASIC / ABR.

- Full control over your business decisions.

- You keep all the profits (minus tax).

- Eligible for small business tax concessions.

Cons:

- You’re personally liable for business debts. Your personal assets are at risk.

- Limited ability to split income or bring in partners.

- Harder to raise funds or attract investors… they can’t very well buy shares in YOU.

Example Cases:

Case 1: (Artist)

Kyla, a freelance mural artist, starts as a sole trader. It’s simple. She only needs an ABN and can manage her taxes under her personal name. If she grew her business, made merch, maybe wanted to own her own gallery, or employ staff to produce some other works, restructuring her business might be important.

Case 2: (Musician)

Mona, an indie singer-songwriter, performs gigs and sells her songs online under her name. She loves the flexibility of being a sole trader. No board meetings, no partners, no paperwork. But when she starts booking festivals abroad, taking more risks, increasing the production values of her music and selling more than her personal services, she realises she needs liability insurance and a better structure to protect her from performance-related risks.

Case 3: (Freelance Videographer)

Katherine films weddings and short films. As a sole trader, her tax is simple and she writes off her camera equipment as business expenses. But when she gets hired by bigger brands, they request invoices under a registered company for credibility. It’s probably time for Katherine to chat to an accountant and consider a switch (we don’t want to just be reactive… but we also don’t want to lose business)!

Case 4: (Content Creator)

Kosta runs a YouTube channel and earns income through ads and sponsorships. As his following grows, he begins hiring editors and buying expensive gear. Profits and risk and copyright licenses might be better managed in another structure… to be discussed with your accountant.

2. Partnership

If you’re teaming up with another creative or let’s say a friend, a partnership might make sense. You share the business, profits, and decision-making… and risk (jointly and severally).

This is something that seems to add up for a lot of people but might actually be super risky. Always chat to a lawyer or accountant before jumping in and registering a Partnership, and always get a written Partner Agreement.

Pros:

- Easy to form - register the ABN and (recommended) write a partnership agreement.

- Shared responsibility and complementary skills.

- Record and report income and expenses of the shared activities.

- Profit passes through to partners (no separate tax for the partnership).

Cons:

- Each partner is jointly and severally liable for debts - even those caused by the other partner.

- Disagreements can cause friction between business partners.

- Partnership lodges its own tax return.

- But the Partnership doesn’t pay income tax… the profits are taxed in the hands of the Partners.

- Changes (add new Partners, get rid of Partners) are a tad harder… it means you have to dissolve the ‘old’ Partnership and create a new one with the new Partners.

Example Cases:

Case 1: (Music Studio)

Nina and Lance run a music studio together. They split profits evenly. It works well until one partner takes a big loan and then leaves the country, without consulting the other. Both become liable for the debt, and if one can’t be found then the other is liable in full. Lesson learned: Partnership is in everything… the profit and the loss.

Case 2: (Design Studio)

Mariah and Steve, two graphic designers, start a small studio together. Mariah handles clients; Steve focuses on design. It’s a great balance until Mariah wants to expand faster than Steve. They realise they should’ve discussed future plans before jumping in.

Case 3: (Cafe Couple)

Bryan and Ashley opened a small cafe. They split duties. Ashley handles the kitchen, Bryan manages front-of-house. The partnership works until Bryan gets another hobby or job and it takes up all his time… so now Ashley is doing most of the work, but Bryan is still entitled to 50% of the profits anyway (as Partner).

4. Company

A company is a separate legal entity. Meaning it can own property, earn income, and owe debts. It offers more flexibility, protection, credibility, and scalability, but with more admin and compliance, and higher costs. It’s like creating / giving birth to a whole new legal entity.

Pros:

- It’s not ‘bullproof’ but there is Limited liability. Personal assets are usually protected moreso.

- Easier to raise capital and bring in investors - You can more easily have multiple owners, add investors later, and have a right to profit and control % that is different for everyone.

- Taxed at a flat company rate (which may be lower than personal tax rates).

Cons:

- More complex and expensive to set up (usually around $1.5k - $5k ish).

- Governed by ASIC = Strict compliance, reporting, and record-keeping.

- More complex accounting.

Example Cases:

Case 1: (Design Agency)

Bonnie runs a fast-growing design agency. To protect her personal assets and attract bigger clients, she incorporates her business. She pays herself a salary, keeps profits in the company for tax efficiency, and enjoys peace of mind knowing her personal savings aren’t on the line.

Case 2: (Software Startup)

Edsel and two developers create a mobile app. They register as a private company so they can issue shares, attract investors, and protect themselves from personal liability if the venture doesn’t work out.

Case 3: (Production House)

Tyler turns his film freelancing gig into a production company. With a team of editors, stylists, and cameramen. Having a company structure gives him credibility and helps him bid on corporate contracts that require a registered entity.

Case 4: (Boutique Clothing Brand)

Joyce builds a small fashion label. Her accountant advises forming a company to separate her personal funds from the business. This makes bookkeeping cleaner and helps her apply for small business loans under the company name instead of her own.

4. Trust

A trust is a bit more complex. It’s like a container that holds assets or income for the benefit of others (the beneficiaries). Commonly used for family businesses or long-term investment planning. There are LOTS of different types - unit trusts, discretionary trusts and many others. The most common in business (/for our clients) are discretionary trusts, where a trustee manages assets for the beneficiaries and has the discretion to decide on how to distribute income.

Pros:

- Flexibility to distribute income among family members

- Can protect assets from creditors

- May offer tax planning advantages

Cons:

- Can be costly to establish and maintain

- Complex legal and tax obligations

- Losses are trapped in the trust. They can’t be passed on, but they are used to offset/reduce future profits.

Example Cases:

Case 1: (Family Art Studio)

The Hooper family owns an art supply shop and gallery. Using a discretionary trust allows them to share profits with family members while protecting the building (their main asset) from personal risks.

Case 2: (Property Investor)

Dani, a freelance architect, also invests in rental properties. She sets up a trust to hold the properties and distribute the income among her family members in lower tax brackets. This saves tax and protects her from tenant-related liability.

Case 3: (Production House)

The Danganan family runs a small production house through a discretionary trust. It helps them distribute income between family members efficiently and provides asset protection. However, they rely on accountants to manage the setup and yearly tax work, as it’s not a DIY option.

Case 4: (Multi-Generational Bakery)

The Santiago family has run their bakery for 29 years. They shift ownership to a trust to make succession easier. The parents can retire peacefully knowing the trust structure keeps control within the family and avoids messy ownership transfers later.

Often you will see a combination of structures, for example where a Trust is created to hold the shares of the Company, on behalf of the beneficiaries (the individual humans ultimately running the show).

So, Which One’s Right for You?

There’s no one-size-fits-all answer. It’s truly best to speak to a professional (accountant or lawyer).

Here’s a good place to start:

- Just starting out or freelancing? - Sole Trader

- Working with a friend or partner? - Partnership or Company

- Growing fast, big profits, keen to sell or want to protect assets - Company

- Family business or asset protection focus - Trust and/or Company

Before deciding, think about where you want your business to be in a few years. You can always talk to us, and we’ll be happy to tailor some advice regarding your creative journey.

Building your dream business is exciting. Choosing the right business structure just makes sure it stays standing. It’s important to get it right, at the start, but also to know your goals and understand risk exposure so you don’t overcook it and pay the price.

Start simple, grow smart, and keep creating magic!