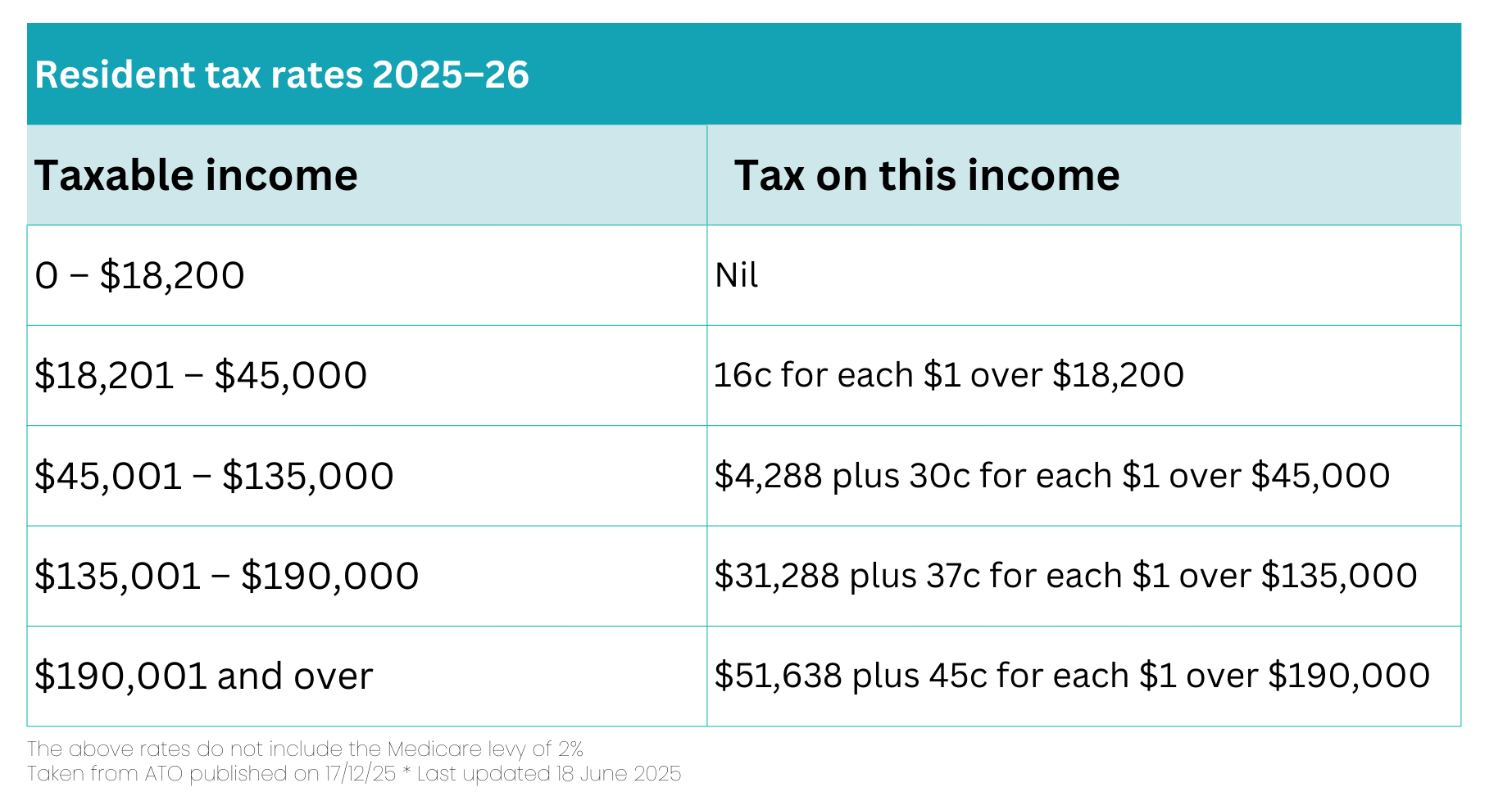

Tax-free threshold

Do you love surprises?

Woohoo, we do too! But when it comes to a surprise tax bill – no thanks. The good news is, you can actually earn a certain amount without paying any income tax at all.

Yes, really!

If you’re an Australian resident for tax purposes, you can earn up to $18,200 in a financial year before the tax office takes a cut. This is what’s called the tax-free threshold.

What is the Tax-Free Threshold?

The tax-free threshold is the amount of income you can earn each financial year before paying any income tax. For Australian residents, this figure is $18,200. Think of it as your ‘tax-free allowance’. That means you don’t pay tax on the first $18,200 you earn, and tax only starts being withheld/incurred once you go above this amount.

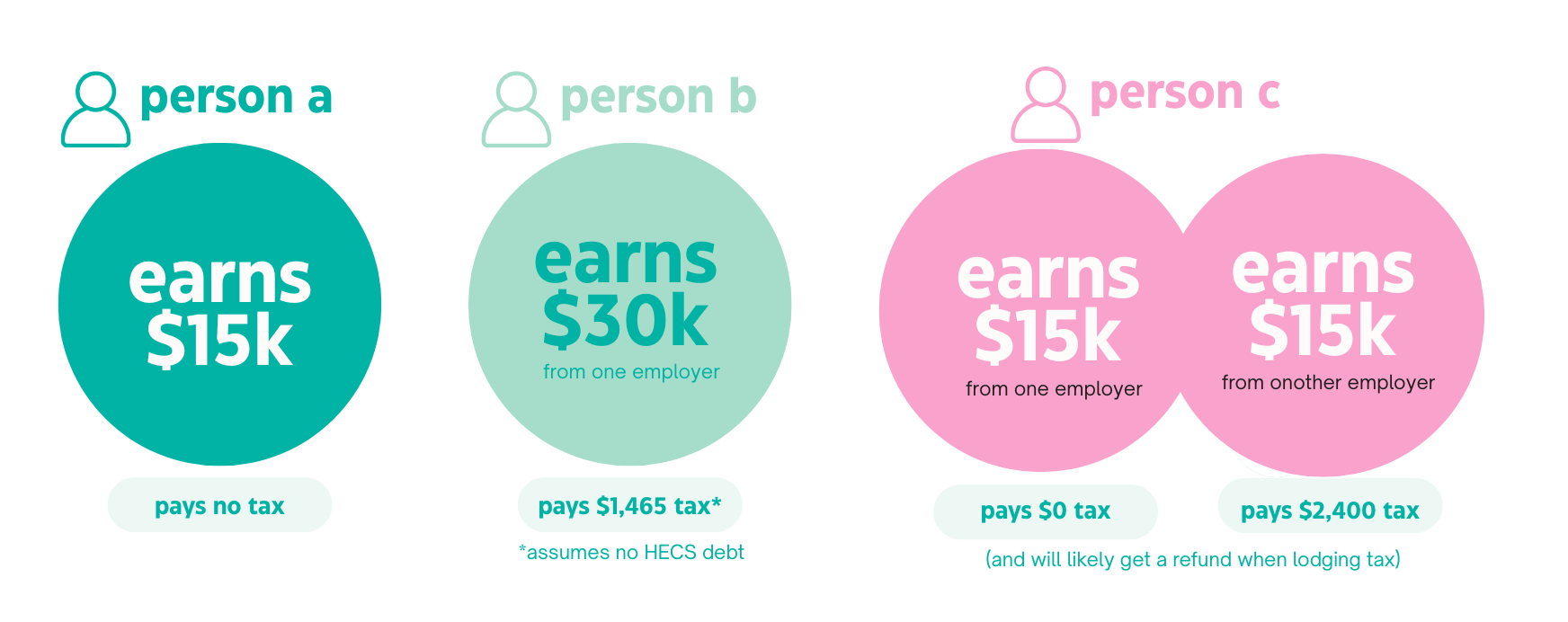

Some examples:

(using 2026 FY rates, excluding medicare levy, and assuming no HECS is applicable)

So, who actually gets this benefit?

✅ Australian residents for tax purposes can claim it.

❌ Non-residents don’t get this perk, which means they pay tax from the very first dollar they earn.

More on residency rules here.

If you only live in Australia for part of the year, you won’t automatically get the full $18,200. Instead, it’s split into 2 parts, which can result in a lower tax-free threshold:

- a flat amount of $13,464

- plus up to $4,736, which is pro-rated based on the number of months you were a resident in Australia during the income year (including the month you arrived).

Example: Arriving in October (for FY2026: 1 July 2025 - 30 June 2026)

Let’s say you became an Australian resident for tax purposes in October 2025. That means you were a resident for 9 months of the financial year (Oct 2025 → June 2026).

Here’s how your tax-free threshold would be calculated:

- Flat amount:

$13,464 (everyone who qualifies gets this in full). - Pro-rated portion:

- Maximum additional amount = $4,736

- Divide this by 12 months = $394.67 per month

- Multiply by 9 months (Oct 2024 – Jun 2025) = $3,552.03

- Total tax-free threshold:

$13,464 + $3,552.03 = $17,016.03

So in this case, instead of the full $18,200, your personal tax-free threshold would be about $17,016 for FY2026

How to Claim the Tax-Free Threshold?

Don’t worry – it’s super easy. If you are employed, your payroll officer/employer takes care of this. There’s no need to deal with the ATO directly; it all happens through a form your employer gives you.

Here’s how it works:

- Get the TFN declaration form - When you start a new job, your employer will hand you a Tax File Number (TFN) declaration form. This is where you let them know if you want to claim the tax-free threshold.

- Tick ‘Yes’ to the threshold question - On the form, there’s a section asking if you want to claim the tax-free threshold from this payer. If this is your main job (usually the one where you earn the most), tick Yes. This tells your employer how much tax to withhold – so you won’t pay any on the first $18,200 you earn for the year.

- Update if things change - If you switch jobs, you’ll need to fill in a new TFN declaration with your new employer. That’s when you choose again whether to claim the threshold with them or not.

HOT TIP!!

If you have more than one job, only claim the threshold with your main employer. (We’ll cover this in more detail below.)

If you work for yourself, then it is calculated by the ATO automatically when lodging your tax return.

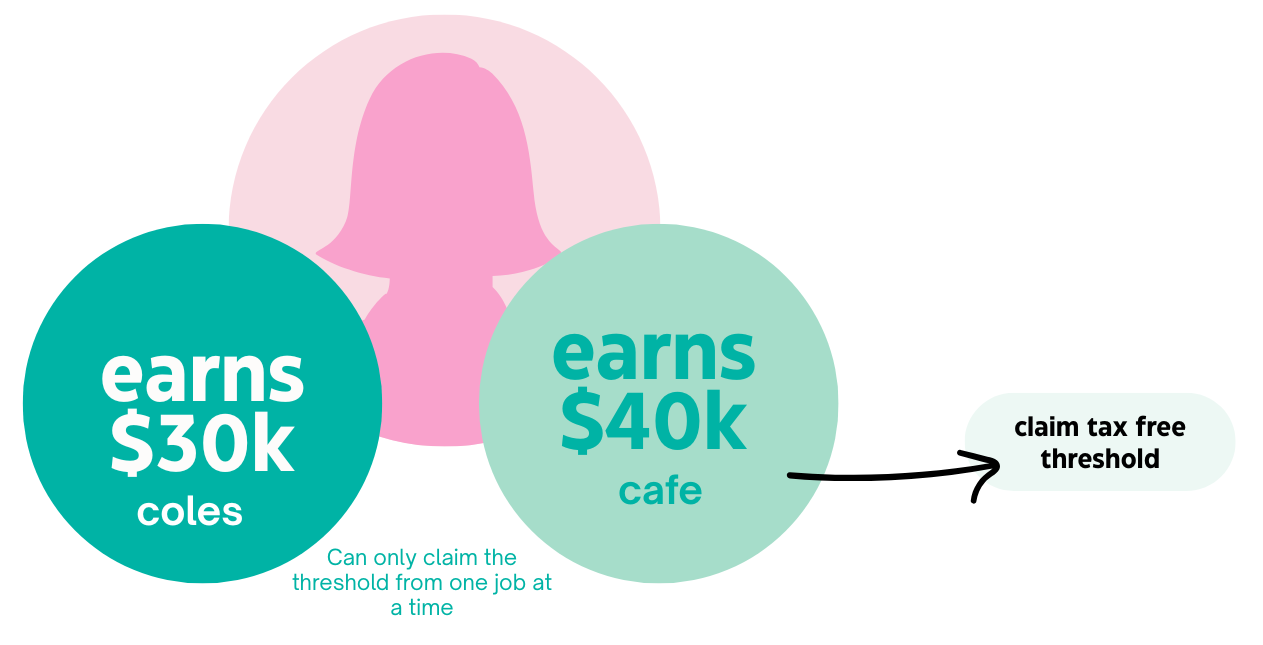

Multiple Jobs or Changing Jobs

Here’s where things can get a little trickier. If you’ve only got one employer, claiming the tax-free threshold is simple – tick ‘Yes’ and you’re done. But if you’re juggling more than one job, or you’ve changed employers during the year, you’ll need to be a bit more careful.

Here’s what to keep in mind:

- Only claim the tax-free threshold with one employer

You should only claim the threshold from one job at a time – usually the one where you earn the most. This way, the most accurate amount of tax is withheld overall.

Example: Rory works full-time as a barista in a busy café and also does a few shifts a week at Coles. Since the café is her main income, she claims the threshold there and ticks ‘No’ for Coles.

- Your other jobs will withhold from the first dollar

For your second (or third) job, you should tick ‘No’ on the TFN declaration. This means that tax will be withheld from every dollar you earn in those jobs.

Example: Dean is a tradie during the week and works in a bar on the weekends. He ticks ‘Yes’ for his tradie job, and ‘No’ for bar work – so his bar income is taxed from the first dollar earned.

- Changed jobs? Fill out a new form

If you leave one job and start another, your old employer stops withholding for you. You’ll need to complete a new TFN declaration with your new employer to claim the tax-free threshold again.

Example: Emily leaves her admin role in June and starts working at a local council office in July. She fills out a fresh TFN declaration with the new employer and ticks ‘Yes’ to keep claiming the threshold.

- Low total income?

If you’re confident your total income from all jobs will be less than $18,200 for the year, you may be able to claim the threshold from more than one payer. Just be careful – if you underestimate, you could end up with a tax bill later.

Example: Luke works casually at a deli counter and also pulls pints at a pub on weekends. He expects to earn only $15,000 in total for the year, so he can claim the threshold from both jobs. But if he ends up going over $18,200, he might owe tax at tax time.

Think of it this way: the $18,200 tax-free amount is like one pizza. You can’t split the same pizza across multiple jobs – it only applies in full to one.

Paying Tax on Multiple Sources of Income (with PAYG Withholding Variation)

Here’s something important to remember: at tax time, the ATO doesn’t look at your jobs separately. All your income – from every employer, side hustle, or other source – is added together to work out your total taxable income.

Case Studies: How the Tax-Free Threshold Works in Different Situations

Let’s see how this plays out in different work setups. These examples show employer-side PAYG withholding estimates, excluding the Medicare levy. Each employer only knows what you declare on your TFN declaration form, so your total income across jobs isn’t combined until you lodge your tax return.

(All figures are based on FY2025–26 ATO resident tax rates.)

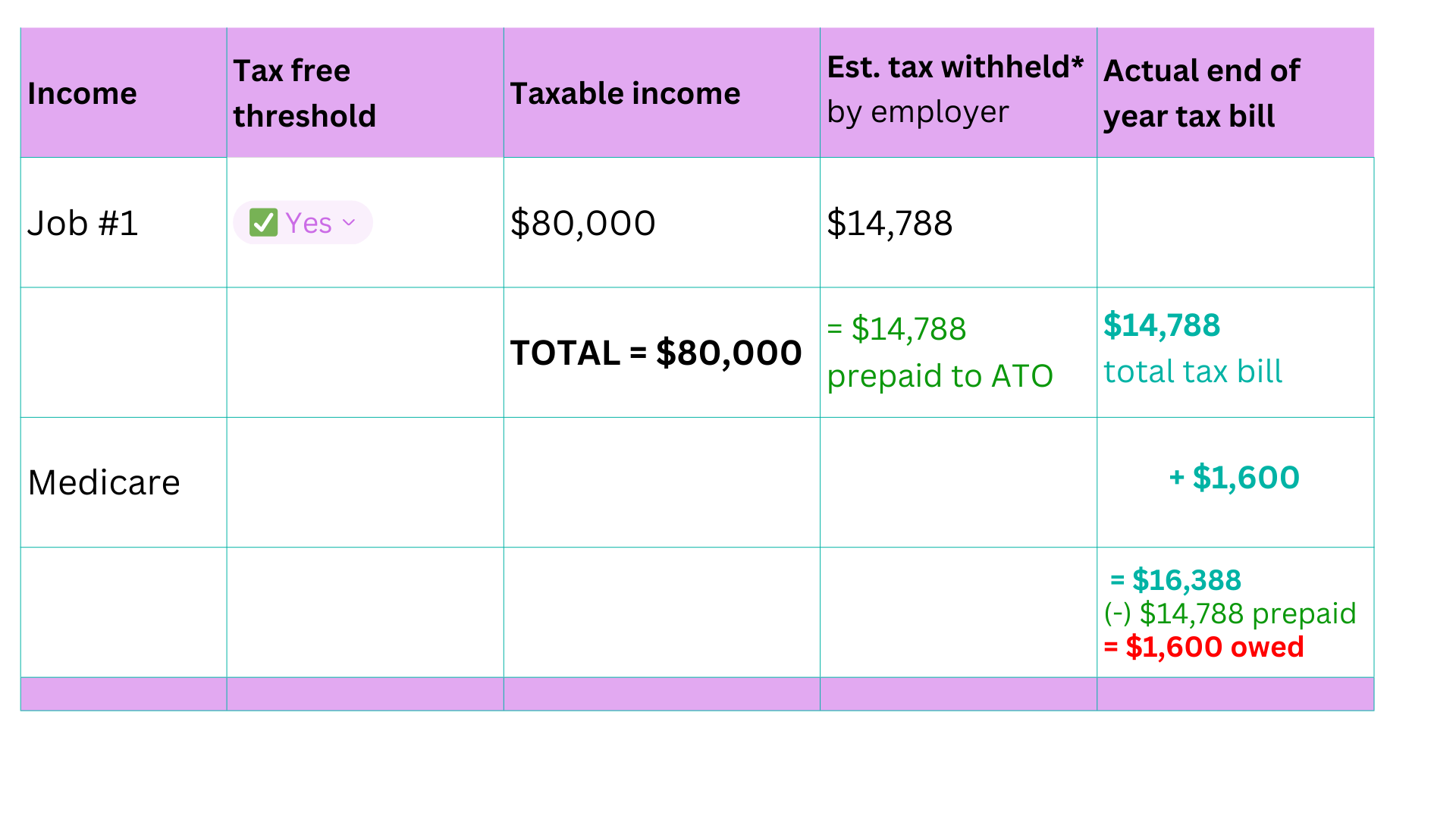

Example 1: Lane – One Full-Time Job

Lane works full-time as a graphic designer, earning $80,000 a year from a single employer. Since Lane only has one job, she claims the tax-free threshold with that employer.

*How it is calculated:

Graphic Designer (tax free threshold claimed)

Explanation:

- Lane’s employer applies standard PAYG rates for someone claiming the threshold.

- Because she has no other employer, no extra withholding adjustments are needed.

- She is only likely to get a tax refund when she lodges if she has extra tax deductions to claim.

Her take-home pay already reflects the correct tax withheld, with minimal surprises at year-end.

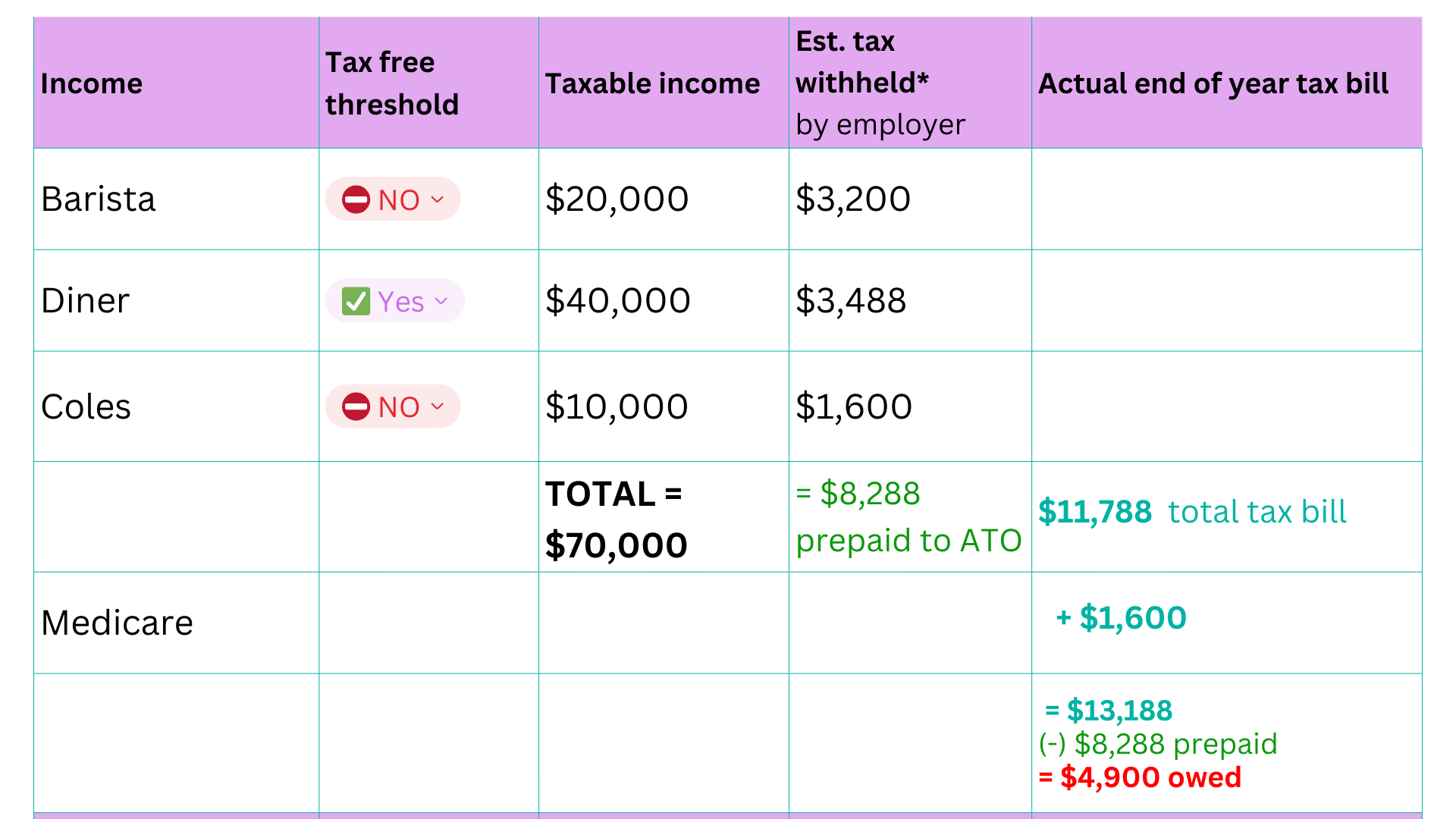

Example 2: Rory – Multiple Casual Jobs

Rory juggles three casual jobs:

- Barista ($20,000)

- Diner crew ($40,000)

- Coles team member ($10,000)

That’s $70,000 total across three employers. She can only claim the tax-free threshold with one of them – so she ticks Yes for her main income (the diner) and No for the others.

*How it is calculated:

Barista Job

Diner Job (tax free threshold claimed)

Coles Job

How the ATO calculates the TOTAL (hence the difference / amount left owing):

$70,000 total taxable income

Explanation:

- Each employer calculates PAYG separately, as they don’t know her total income across all jobs.

- The diner applies the tax-free threshold scale, while the others use the ‘no threshold’ scale (higher withholding).

- When Rory lodges her tax return, the ATO will reconcile her total income ($70,000).

- She is only likely to get a tax refund when she lodges if she has extra tax deductions to claim.

She has a balance due (annoying!), but each of the employer withholdings are done correctly. This is why we suggest PAYG-W variation forms!

*PAYG-W: The W stands for ‘withholding’ - we’ll explain it further on.

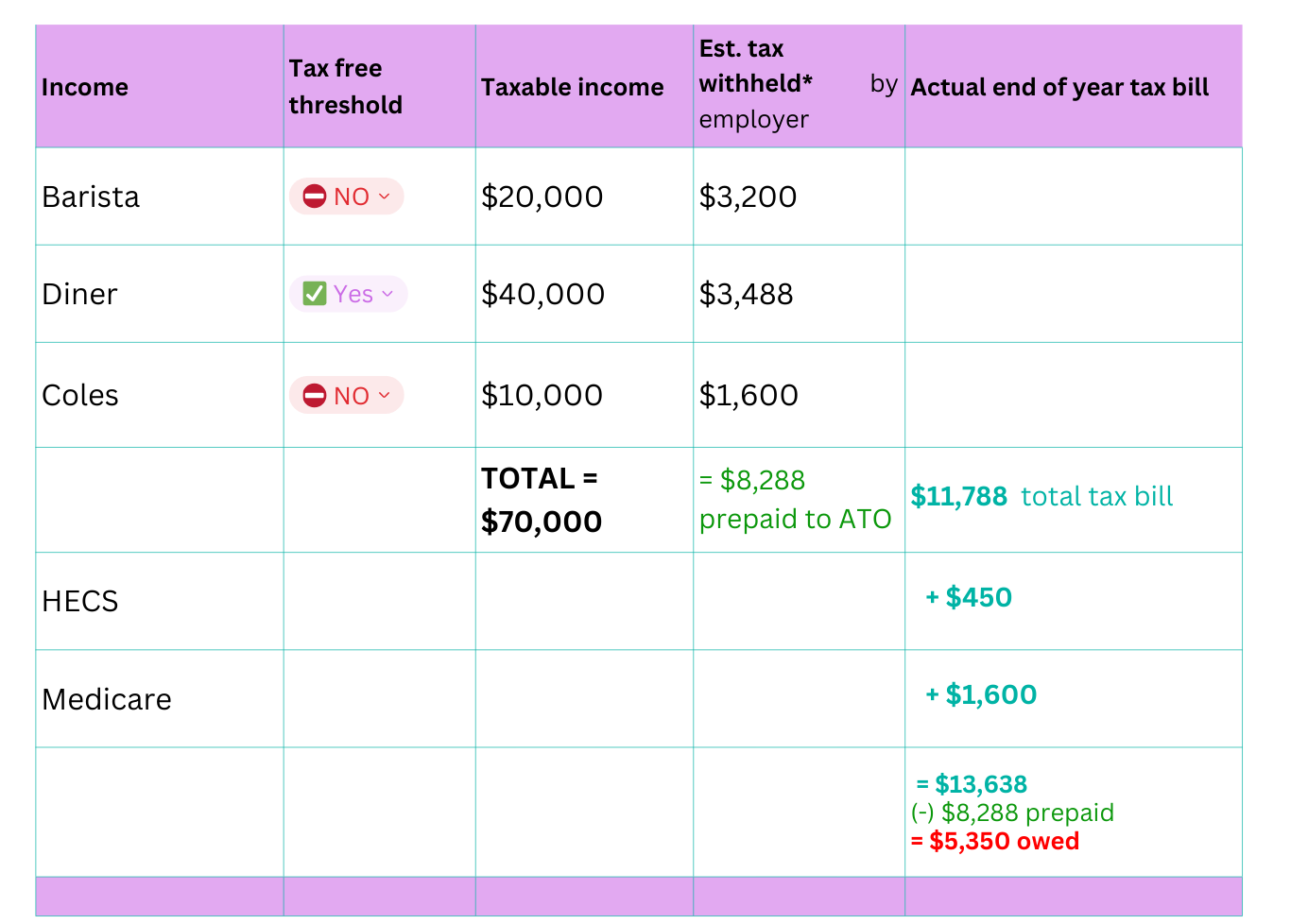

Example 2A: Rory – Multiple Casual Jobs + HECS DEBT

Rory juggles three casual jobs:

- Barista ($20,000)

- Diner crew ($40,000)

- Coles team member ($10,000)

That’s $70,000 total across three employers AND Rory has a HECS Debt. She can only claim the tax-free threshold with one of them – so she ticks Yes for her main income (the diner) and No for the others.

Important Note: each income source is under the HECS threshold ($54k), but the total income (when all added together) is over the HECS repayment threshold. This will almost definitely result in a larger tax bill owing at the end of the year (unless Rory does a PAYGW variation).

Barista Job

Diner Job (tax free threshold claimed)

Coles Job

How the ATO calculates the TOTAL (hence the difference / amount left owing):

$70,000 total taxable income

and HECS repayment

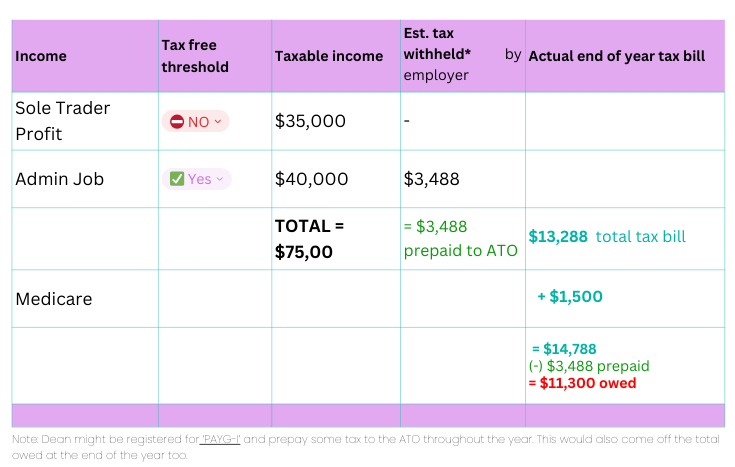

Example 3: Dean – Sole Trader + Employment

Dean is an artist (sole trader) earning $35,000 profit (i.e. business income minus business expenses = profit <<< this is the bit that gets taxed at year end), and also works part-time as an admin earning $40,000 a year.

For his admin job, he claims the tax-free threshold. As a sole trader, no tax is withheld automatically – he’ll need to set aside tax or make PAYG instalments himself.

*How it is calculated:

Admin Job (tax free threshold claimed)

How the ATO calculates the TOTAL (hence the difference / amount left owing):

$75,000 total taxable income (i.e. salary + profit)

Explanation:

- Dean’s employer withholds tax only for his admin role.

- He’ll need to manage tax for his sole trader income, usually via quarterly PAYG installments.

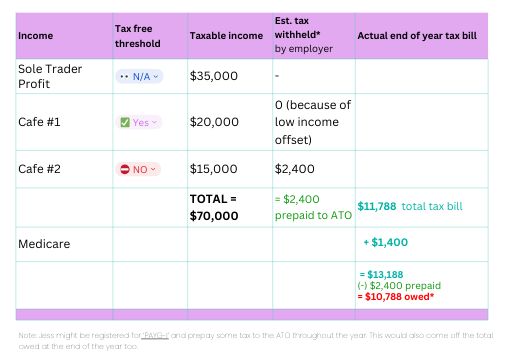

Example 4: Jess – Two Casual Jobs + Sole Trader Income

Jess is a musician (sole trader, earning $35,000 profit) and also works as a barista at two cafés – Café A ($20,000) and Café B ($15,000). That’s $70,000 total income across all sources.

*How it is calculated:

Cafe #1 Job (tax free threshold claimed)

Cafe #2 Job

How the ATO calculates the TOTAL (hence the difference / amount left owing):

$70,000 total taxable income (i.e. salary + profit)

Explanation:

- Jess’ main job claims the threshold, so Café A withholds less tax.

- Café B applies higher withholding (no threshold).

- He’ll also need to budget for tax on his music income.

If each employer handles PAYG correctly; Jess just needs to ensure his self-employed income is covered at tax time.

THE CATCH? Even if each employer / source of income withholds the ‘right’ amount (they think) it might not add up to be enough to cover the total tax applicable on your overall income for the year when everything gets added together.

That’s why claiming the tax-free threshold on more than one job often causes trouble. If too little is withheld overall, you could end up with a tax bill when you lodge your return.

But here’s a helpful tool: the PAYG withholding variation application. It’s a way to ask the ATO to change how much tax is withheld from your pay, so that your withholding matches more closely with what you’ll actually owe.

________________________________

What is a PAYG Withholding Variation?

A PAYG withholding variation is an application you submit to the ATO to reduce or increase the amount of tax withheld from payments made to you by your employer or payer.

It’s useful when the standard tax withholding is too high (e.g. you have extra deductions) or too low (if your income or situation changes).

- The variation only applies for one financial year. You’ll need to apply again next year if you still want it.

- You must lodge it by 30 April if you want it to apply for the current financial year. If you apply in May or June, the variation kicks in from 1 July of the next financial year.

You might apply for a variation if:

- You expect to claim a lot of deductions (e.g. work-related expenses, investment property costs) and want less tax withheld throughout the year

- You anticipate your income will drop or change mid-year

- You want to avoid big overpayments or underpayments when you file

For example, property investors often use the variation so they can access tax benefits gradually through their pay rather than waiting for a lump-sum refund.

How to Lodge a Variation

- Decide your amount or rate - estimate your annual income, deductions, and anything else that will show up in your tax return.

- Submit the application - you can lodge it online via myGov (Manage → PAYG withholding variation) or through your tax agent.

- If approved: the changed withholding starts from your next payday after the variation is processed.

- Duration and renewal – the variation ends on the date in the ATO’s approval letter. If you want it to continue, you must lodge a new variation at least 6 weeks before it expires.

Processing times:

- Online: usually within 28 days

- By paper: up to 56 days

Example:

- Lane works a regular job but also does some freelance graphic design. Because of expenses like equipment, software, and her home office, her taxable income ends up lower than the tax being withheld from both jobs.

- To fix this, Lane applies for a PAYG withholding variation. Once it’s approved, her employer withholds less tax from each pay. This way, Lane has more cash in hand throughout the year – and she avoids a big refund or surprise bill at tax time.

______________________________

Quick FAQs about Claiming the Tax-Free Threshold

- Do I need to claim the threshold every year?

Nope. Once you’ve claimed it with your employer, it stays in place unless you change jobs or decide to update it.

- Can I change my answer later?

Sure thing. Just ask your employer for another TFN declaration form and update your choice.

- What if I don’t claim the threshold at all?

That’s fine too – you’ll just have more tax withheld from each pay. You’ll usually get the extra tax back as a refund when you lodge your tax return (as long as it covers other liabilities like a study or training support loan and the Medicare levy).

- Can I claim the threshold with two jobs?

Generally not recommended – you should only claim it from your main job (the one that pays you the most). If you try to claim it with more than one employer, you might not have enough tax withheld, which could lead to a bill later.

- What if my tax withheld feels too high or too low?

You can apply for a PAYG withholding variation. Lodge it before 30 April for it to apply in the current financial year, or in May–June for it to kick in from 1 July of the next year.

The tax-free threshold can seem confusing at first, but don’t worry – you’re not alone. With the basics in mind, it’s much easier to break down and make sense of.

- You can earn up to $18,200 tax-free each year (if you’re an Australian resident).

- Only one job should get the benefit at a time.

- All your income is added up at tax time.

- And if the standard withholding doesn’t feel right, a PAYG withholding variation can help balance things out.

Claim wisely, keep an eye on your forms, and you’ll steer clear of those unwanted tax-time surprises. Only the good surprises, right? 🎉

If you’re still unsure which box to tick or how it applies to your situation, it’s always a smart move to chat with a registered tax agent. And if you’d like some extra guidance, you’re welcome to reach out to us – we’ll walk through your numbers and give you peace of mind, so you can focus on your work and keep more of your hard-earned pay in your pocket.

Sources | References:

How to Claim Tax Free Threshold

Multiple Jobs or Change of Job

Tax & Multiple Sources of Income

Tax Free Threshold and Newcomers