ADELAIDE FRINGE ARTISTS

This is me! Maybe it’s also you?

There are so many beautifully unique people coming to Adelaide each year for the Adelaide Fringe; performers, producers and support crew from all over the world. Hopefully you make some money while here, but what happens when it comes to tax?

This blog is not designed to be personalised tax advice - it is just a heads up and education tool, especially for those people new to our tax system. Please contact me ([email protected]) if you want to book a consult to chat through your individual circumstances and receive our specialised advice.

AUSSIES

If you were born here, live here, and basically do all your work in Australia, then it’s tax as usual. It is not technically that straightforward, but it is most likely you are an Australian resident for tax purposes.

Complete the little quiz here to confirm your residency status. Or, chat to us!

Getting Paid & Tax Obligations

You are likely operating as either an employee or you have an ABN and you are a sole trader. Or a mix of the two!

If you are an artist in someone else’s show and you are engaged as an employee then your employer will withhold some money from your pay (PAYG-W) and pay that to the ATO for you, then they pay you the ‘net’ amount. This is like prepayment of some of your tax. When tax time comes around this info should be automatically in our tax return.

If you are a sole trader the Fringe settlement gets paid to you directly in full (minus credit card fees etc) and then you need to remember to put some aside for tax yourself. When tax time comes around you fill in the business schedule section (re all of your ABN income) and deductible expenses and you get taxed on the profit. Check out our blog on how to save for tax here.

EVERYONE ELSE

Welcome to Australia and thanks for sharing your incredible art with us!

Once the festival finishes, Adelaide Fringe will look to pay you your show settlement. The amount you actually receive and your tax obligations depend on your tax residency status - so step one is to CONFIRM YOUR RESIDENCY STATUS.

Complete the little quiz here to confirm your residency status. If anything is unclear, chat to us! There are a few elements to consider, including but not limited to:

- rental leases you might signed

- Aussie superannuation account

- Aussie bank accounts

- days spent in Australia (this is usually pretty important in the determination)

- spouse/family/property overseas (where your direct family live) i.e. if spouse and kids are in the UK but you are just visiting Australia for one month you might not be a resident for tax purposes.

If you are deemed to be resident:

- Get TFN

- Lodge tax return

- Taxed on worldwide income

- But get resident rates including tax free threshold

If you are deemed to be a non-resident:

- Get TFN

- Lodge tax return

- Taxed on Australian sourced income only

- NO tax free threshold

- Get taxed at special foreign resident tax rates

You need to determine your residency every financial year. It can change year-on-year, and you can also have part of the year as a resident and part as a non-resident. Tax is complicated, I know.

Australian Residents - Getting Paid & Tax Obligations

If you are deemed to be an Australian tax resident for tax purposes then it is a good idea to get a Tax File Number. You might also need an ABN if you are running a business or working for yourself. If you are always going to be employed then there’s probably no need for an ABN.

Just like above for the local artists… if you’re employed then you get the net amount (after your employer withholds tax), or if you are a sole trader then you get the full amount but need to put aside the tax yourself.

Don’t forget to check out our blog on how to save for tax here.

Foreign Residents - Getting Paid & Tax Obligations

It is quite common that visiting performers will be non-residents for tax purposes. This is not always the case of course, but often people are here for just a couple of months and maintain a home and bank accounts abroad, with the full intention of going back. Covid-19 threw a spanner in the works of course and the ATO does understand that.

In almost all scenarios you will need a TFN and still need to lodge a tax return. The residency status determines what income you get taxed on and what tax rates will be applied. This will also impact how much of the show settlement you receive from the festival organiser.

As a foreign tax resident you get taxed on Australian sourced income only. Whereas Australian tax residents get taxed in Australia on worldwide income. Also, as a foreign tax resident there is no ‘tax free threshold’, whereas the first $18,200 of taxable income for Australian tax residents is tax free!

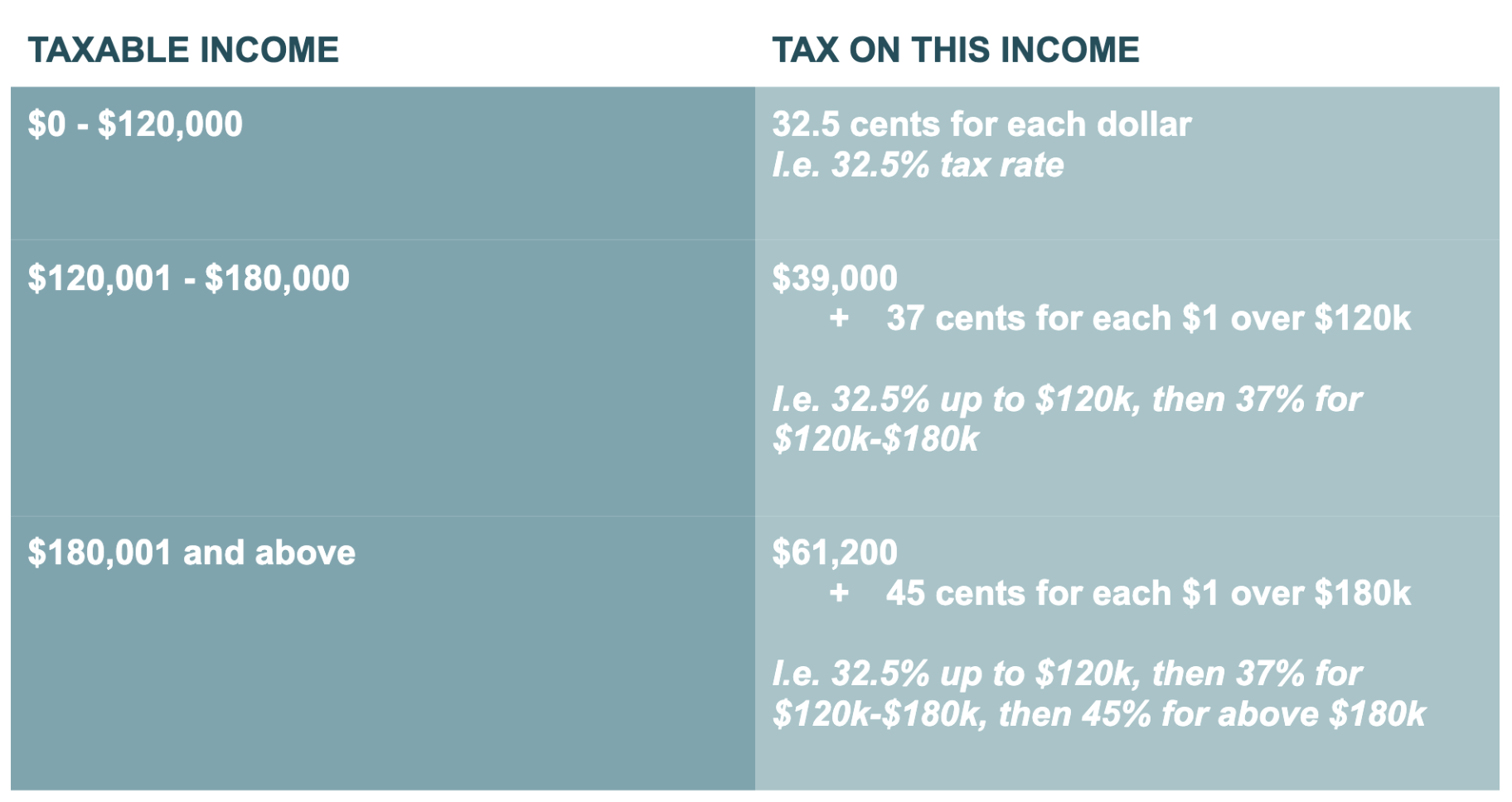

Here are the tax rates that apply to foreign tax residents at the time of writing (FY2022):

If you are running a business/working for yourself, then the festival won’t ask you for your TFN usually, but would want your ABN. If you provide an ABN then they might be able to distribute the full amount to you (and then you are responsible for putting tax aside, lodging the tax return and at that time paying the ATO the tax you owe on that income). Be sure to check the tax rates table above and put a sufficient amount aside. If you are employed, then the festival organiser will ask you to fill in a Tax Declaration Form. On this, you provide your TFN and you tick the box that says that you are a foreign resident. Then your employer should know how much to withhold from your pay. When you lodge your tax return at the end of the financial year it is likely, but not always the case, that the tax bill has already been paid via these withholdings.

If you have not provided the festival organiser with a Tax File Number (TFN) or Australian Business Number (ABN) then they may* have to withhold 49% of your settlement (boo, less money in your pocket!) and give it to the ATO on your behalf.

To help festival organisers in managing visits by foreign performers, the ATO have varied some of the withholding obligations that usually apply. Generally this is for when they are paying you as an employee and withholding PAYG-W from your pay.

Read the ATO’s information about this here.

*Note: You would need to apply for an exemption/variation downwards - check out the ATOs info on this here. You as the payee need to apply for the variation, and you can do it online through MyGov (if you have one!) or request a paper form here by searching ‘NAT 2036’.

If your pay would be under $10,000 then the exemption is likely to be approved, and Adelaide Fringe can likely just pay the full amount to you without withholding the 49%.

If your pay is over $10,000 per touring party member (including support staff), then you can still apply. You, the payee or their agent will be required to provide a detailed budget for the individual act. A variation of the withholding rate to nil will be granted where the ATO is satisfied a performer or act will have either no, or little tax to pay in Australia. Each case is different!

Where a withholding variation to nil is granted, there is no requirement to apply for an Australian business number (ABN). The variation notice we issue will remove the requirement to withhold where the payee does not quote an ABN.

So what happens if there is no exemption granted? Then either Fringe withholds 49% (gross) or you look at getting a TFN and maybe an ABN too. You will also need to consider your tax residency status, Australian or foreign resident for tax purposes, and you will also likely need to lodge a tax return!

VISAS

Sometimes the visa you come into Australia with might also impact tax rates and obligations, so it is important to keep this in mind.

Our understanding is that most artists come here on the 408 Entertainment Visa (‘temporary activity visa’). If so, then everything we’ve already been through applies: figure out residency status first, and then you will know which rates apply to you and your obligations. Even though the visa might allow you to stay for up to two years, the ATO tool might suggest you are still a non-resident for tax purposes. It really depends on lots of factors.

If you came to Australia on a Working Holiday Maker (WHM) Visa, then read up on the tax implications here. Basically, it is likely that you will be a non-resident for tax purposes, but you will still need a TFN and will need to lodge a tax return.

If you are employed you can tick the WHM box on the tax declaration form, and then your employer will withhold from your pay a different rate of tax to what the usual non-resident tax rates suggest (see table above for those ones). They will likely withhold tax at a rate of 15% for the first $45,000 you earn (for FY2021 onwards). Higher rates apply above that threshold, and you can check all the rates here.

Just to complicate things a little more, if you are from a ‘Non-Discrimination Article’ (‘NDA’) country, and you are deemed to be an Australian resident for tax purposes, then a different lower/better rate may apply to you. The UK is one of these! Read more here. The idea is that the ATO cannot tax you at WHM or non-tax resident rates (which are both less advantageous) and must tax you as if you were an Australian national if you are from one of those countries.

Totally confused still? Got a more complicated situation?

This is why tax agents like us exist.

Get a quote

Sometimes there is a simple answer and other times we need more than a blog to get our heads wrapped around tax, and that is ok! Reach out any time and we can send you a quote for a consultation and provide you personalised help.

Xxx Lauren